Source: The College Investor

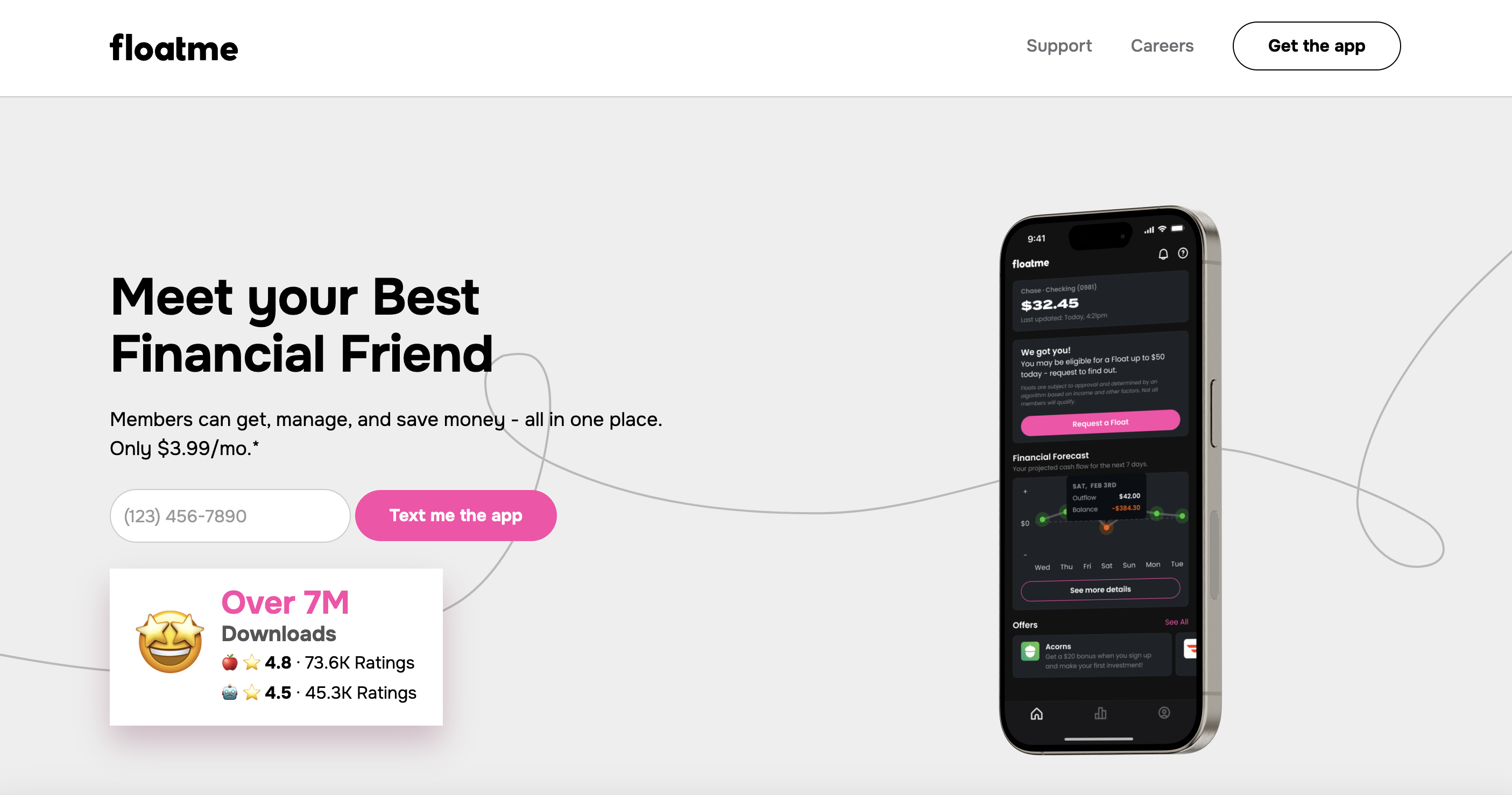

FloatMe is a fintech app that offers $50 cash advances between paychecks. While there is a monthly fee, there are no interest charges and no credit check is required for approval.

FloatMe is one of a growing number of cash advance apps that are designed to cover small loans.

Cash advance apps like FloatMe can help you out small emergencies. But can you access more than $50, and is FloatMe worth the fees? We answer those questions and more in this full review.

- Obtain $50 cash advances to cover small emergencies

- No credit check required

- No interest charges

- $3.99 monthly fee

What Is FloatMe?

FloatMe is a fintech app that enables users to receive small cash advances to cover minor expenses between pay days. In addition to cash advances, FloatMe offers some basic financial management tools to help you monitor your bank account transactions, and forecast your balances.

Source: The College Investor screenshot of FloatMe

What Does It Offer?

FloatMe offers two primary services: Cash advances, known as Floats, and Personal Financial Management Services. Here’s a closer look at what’s included

Floats

Users eligible for Floats can receive cash advances of up to $50 at no cost, transferred into a linked bank account via ACH deposit. Transfers take between 1 and 3 business days for processing; however, you can also request an “Instant Deposit” for an additional fee through your debit card. Instant deposits can be received within minutes.

FloatMe does not charge any interest, but there is a monthly fee of $3.99, whether you use the cash advance service or not. You can only take out one cash advance at a time, and you must repay your current advance in full before you can qualify for another one.

You can be eligible for Floats if you are 18 years of age, are a U.S. citizen or permanent resident, have a valid SSN or TIN, and have a physical address anywhere in the U.S. besides Maryland, Connecticut, Washington D.C., or a U.S. territory.

Financial Forecast

FloatMe’s Financial Forecast feature predicts your account balance seven days into the future by analyzing your deposit and spending habits. You’ll receive a notification if the data indicates that you may be in danger of overdrawing your account (nonsufficient funds). While you should not rely solely on FloatMe’s analysis, it can be a helpful money management tool.

Are There Any Fees?

There is a $3.99 monthly fee to use FloatMe’s cash advance service. There is also an additional fee if you request an Instant Transfer. This fee ranges between $3 and $7 depending on the cash advance amount.

How Does FloatMe Compare?

Earnin is similar to FloatMe in that it offers cash advances that are repaid from your linked account. However, Earnin doesn’t charge any mandatory fees, and you can draw up to $750 per pay day, much higher than FloatMe. Earnin will accept tips, but you can tip $0. There are also no monthly fees. Like FloatMe, if you want to receive your advance quickly, you can pay extra for an instant transfer.

Brigit is similar to FloatMe in that it offers cash advances based on subscription pricing. There is a free version that provides access to budgeting and account monitoring tools, however, if you want access to cash advances, you’ll have to pay at least $9.99 per month. Brigit has a higher cash advance limit than FloatMe ($250) and more tools to offer, including Credit Score Monitoring, but it is significantly more expensive.

How Do I Open An Account?

You can open a FloatMe account through the mobile app. Once you’ve downloaded the app, your first step will be to create a username and password. FloatMe will then as you to provide some personal information, including your name, mailing address, email address, phone number. Note that to access cash advances, you will have to link your bank account to FloatMe

Is It Safe And Secure?

Yes, FloatMe is safe to use. The company uses the same levels of security that banks and other financial institutions use for their online banking platforms. Additionally, FloatMe partners with Plaid to access your bank account information, and transfer funds back and forth. Plaid is a third party that securely links your bank account to various fintech apps.

How Do I Contact FloatMe?

FloatMe does not offer telephone or live chat support. The FloatMe Support page has a Help Center where you can get answers to many common questions. There is also an FAQ section on the website. If you still need help, you can submit a question via the online contact form or by emailing [email protected].

Is It Worth It?

While it’s nice that FloatMe does not charge interest on cash advances, you can only borrow $50 at a time, and you have to pay a $3.99 monthly subscription. Earnin has no mandatory fees, allows you to borrow up to $750 per cash advance, and offers more tools, including credit score monitoring. If you don’t mind paying the monthly fee, and only forsee requiring small cash advance amounts, then FloatMe might be worth it. After all, the monthly fee beats getting a $35 NSF charge. Otherwise, we recommend you look elsewhere.

Check out FloatMe here >>

FloatMe Features

|

Cash Advances, Account Forecasting |

|

|

Web/Desktop Account Access |

|