European Central Bank (ECB) policymakers announced their unanimous decision to lower their main deposit rate by 0.25% as expected, following its previous cut in June.

The central bank cut its deposit facility rate from 3.75% to 3.50% and its main refinancing rate from 4.25% to 3.65%, citing weaker growth prospects due to slower private consumption and investment activity.

Link to ECB September Monetary Policy Statement

Updated economic projections featured slight downgrades to growth estimates at just 0.8% this year and 1.3% next year compared to the 0.9% and 1.4% forecasts back in June.

Meanwhile, estimates for headline inflation remained unchanged at 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026. Core inflation projections were even revised higher to account for stronger price pressures in the services sector.

During the presser, ECB head Lagarde reiterated that they are refraining from pre-committing to a set path of interest rate changes. She also explained that they are looking at a wide range of indicators, adding that moderating labor cost pressures are counteracting the impact of services inflation.

Market Reactions

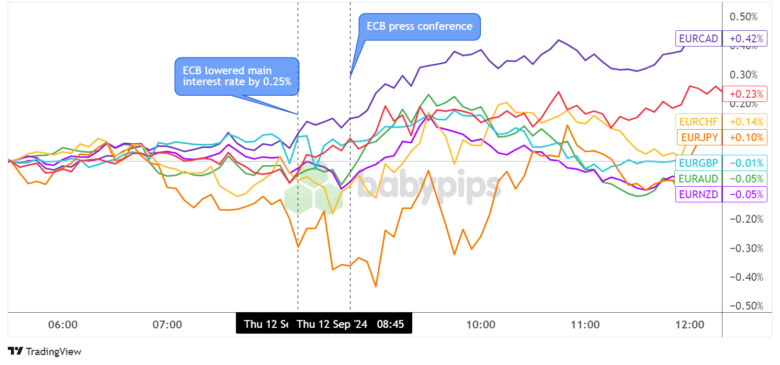

Euro vs. Major Currencies: 5-min

Overlay of EUR vs. Major Currencies Chart by TradingView

The euro, which had been cruising carefully in ranges earlier in the day, already saw a slight pickup in volatility around an hour before the actual ECB event.

EUR/JPY and EUR/CHF already started edging lower before the announcement while EUR/CAD and EUR/GBP were slightly on the rise. The ECB statement, which came in mostly in line with expectations, did not seem to pus the shared currency in a clear direction, as it popped a bit higher against the yen while continuing to slide against the franc and returning some gains versus sterling.

EUR/CAD and EUR/USD kept climbing, though, and Lagarde’s press conference appeared to sustain these pairs gains, eventually joined by EUR/AUD and EUR/NZD. EUR/JPY, which initially dipped during the presser, also pulled higher with EUR/CHF after Lagarde’s remarks.