The major assets were all over the place on Monday, as traders priced in the Fed’s rate cut, escalating Middle East tensions, and potential global growth slowdown.

Which headlines caught traders’ attention in the last trading sessions?

We’re talking about them below!

Headlines:

- New Zealand trade deficit jumped to 2.20B NZD in August, July’s deficit revised higher from 963M NZD to 1.02B NZD

- Judo Bank Australia manufacturing PMI slipped from 48.5 to a 52-month low of 46.7 in September; Services PMI dipped from 52.5 to a two-month low of 50.6

- HCOB Flash France manufacturing PMI for September: 44.0 (44.3 expected, August reading revised higher from 42.1 to 43.9); Services PMI at 48.3 (53.0 expected, 55.0 previous)

- HCOB Flash Germany manufacturing PMI for September: 40.3 (42.4 expected and previous); Services PMI at 50.6 (51.1 expected, 51.2 previous)

- HCOB Flash Eurozone manufacturing PMI for September: 44.8 (45.7 expected, 45.8 previous); Services PMI at 50.5 (52.3 expected, August reading revised lower from 53.3 to 52.9)

- S&P Global Flash U.K. manufacturing PMI for September: 51.5 (52.3 expected, 52.5 previous); Services PMI at 52.8 (53.5 expected, August reading revised higher from 53.3 to 53.7)

- U.K. CBI industrial order expectations worsened from -22 to -35 (-23 expected) in September

- U.S. Flash PMIs show slower hiring and rising inflation in September

- FOMC voting member Raphael Bostic cited cooling inflation and job market prospects as reasons why he supported a 50bps rate cut, adding that “normalizing monetary policy sooner than I thought would be appropriate even a few months ago.“

- FOMC voting member Austan Goolsbee favors interest rates coming down “significantly going forward” to factor in the labor market’s potential deterioration and the lag of monetary policy changes

- Canada new housing price index stagnated (vs 0.1% expected, 0.2% previous) in August

- au Jibun Bank Japan flash manufacturing PMI for September: 49.6 (49.9 expected, 49.8 previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Markets were all over the place on Monday, as traders reacted to the Fed’s rate cut, rising Middle East tensions, and concerns about a global growth slowdown.

Crude oil started strong, supported by growing geopolitical risks and cyclone threats in the Gulf of Mexico. But weak PMI readings from Europe and U.S. and China’s growth worries dragged U.S. oil prices from a high of $71.77 down to $69.47 before bouncing back to settle around $70.65.

Gold found a lift from central bank buying, geopolitical jitters, and the Fed’s recent rate cut. The precious metal briefly dipped under the weight of USD strength during the London session, but ended the day hitting new record highs at $2,628.

Elsewhere, markets reflected broad support among Fed members for a 50bps rate cut. The S&P 500 and Dow closed at fresh record highs, while U.S. 10-year yields touched 3.79% before Goolsbee’s speech helped pull them back to 3.75%.

FX Market Behavior: U.S. Dollar vs. Majors:

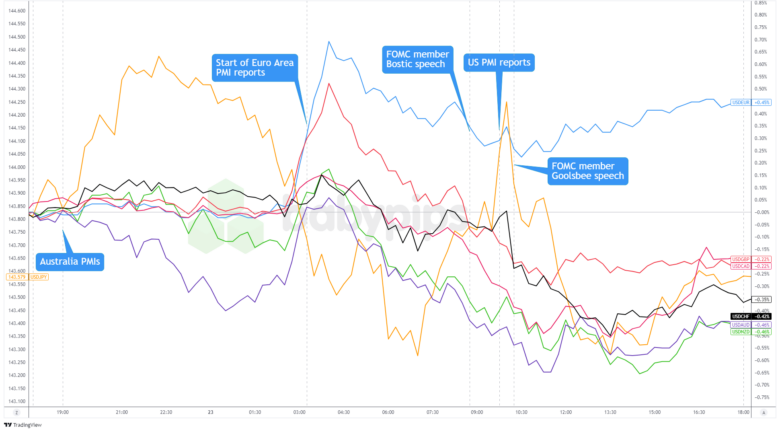

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar kicked off the week with modest losses against most of its counterparts. The one exception was USD/JPY, likely due to Japan’s markets being closed for a holiday. AUD/USD, on the other hand, saw solid gains after the PBOC boosted its economy by cutting its 14-day reverse repo rate by 10 basis points.

The Greenback surged just before the London open and gained even more momentum as weaker-than-expected European PMI data fueled talk of an ECB rate cut and raised concerns about global growth.

But for USD bulls, the rally didn’t last long. Speculation of further Fed rate cuts soon weighed on the dollar, and weak employment data in U.S. PMI reports and FOMC members backing last week’s rate cut added to the pressure. It wasn’t until after the London session close that the dollar found some stability, pulling back and settling into a range.

Upcoming Potential Catalysts on the Economic Calendar:

- RBA’s policy decision at 4:30 am GMT, presser to follow at 5:30 am GMT

- BOJ Gov. Ueda to give a speech at 5:05 am GMT

- German IfO business climate at 8:00 am GMT

- U.S. S&P house price index at 1:00 pm GMT

- FOMC voting member Michele Bowman to give a speech at 1:00 pm GMT

- U.S. CB consumer confidence at 2:00 pm GMT

- U.S. Richmond manufacturing index at 2:00 pm GMT

- ECB member and Bundesbank President Nagel to give a speech at 4:00 pm GMT

- BOC Gov. Macklem to give a speech at 5:10 pm GMT

- Australia’s CPI reports at 1:30 am GMT (Sept 25)

Central bankers will be front and center in the next trading sessions as the RBA drops its September policy decisions!

Later, FOMC voting member Michele Bowman – lone dissenter in last week’s decision – will share her two cents during the U.S. session. ECB’s Nagel and BOC’s Macklem could also shake up the euro and the Loonie’s price action during their scheduled speeches.

On top of that, mid-tier U.S. data releases could influence the dollar’s intraweek trends ahead of Friday’s highly anticipated U.S. core PCE price index.

Don’t forget to check out our brand new Forex Correlation Calculator!