The U.S. ISM manufacturing PMI survey for September came in weaker than expected, as the index held steady at 47.2 to reflect the same pace of industry contraction instead of improving to the 47.6 consensus.

This marked the sixth consecutive month that the index stayed below the 50.0 mark, as majority of components reflected a slowdown for the period. In particular, the prices sub-index fell 5.7 points to 48.3 from its August reading of 54, its first contractionary reading so far this year.

The employment component came in at 43.9, down 2.1 points from the previous 46 reading, while new orders ticked higher from 44.6 to 46.1. The production index also improved from 44.8 to 49.8 but remained in contraction while inventories also declined.

Link to U.S. ISM Manufacturing Survey (September 2024)

“Demand continues to be weak, output declined, and inputs stayed accommodative,” noted Chair of the Institute for Supply Management Timothy Fiore.

“Demand remains subdued, as companies showed an unwillingness to invest in capital and inventory due to federal monetary policy — which the U.S. Federal Reserve addressed by the time of this report — and election uncertainty.”

Market Reactions

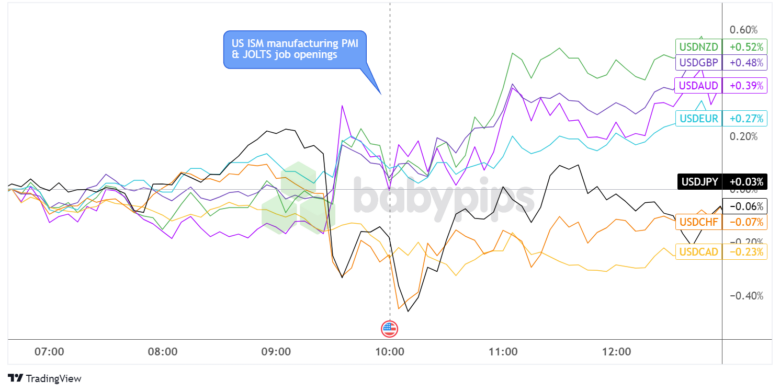

Overlay of USD vs. Major Currencies Chart by TradingView

The Greenback, which saw elevated volatility roughly an hour ahead of the ISM manufacturing PMI release, had a brief bearish reaction to the weaker than expected results.

USD/JPY and USD/CHF had already been cruising lower ahead of the report, so these pairs chalked up the steepest declines afterwards. Dollar losses against the Kiwi and Aussie were quickly pared, as the U.S. currency almost instantly recovered against majority of its peers.

The JOLTS job openings report was also released at the same time, and the numbers turned out stronger than expected as it came in a 8.04 million in July versus the expected 7.64 million reading and the previous 7.71 million figure.