Source: The College Investor

When you take out a student loan (or any other time type of loan), you have to pay interest. Interest is simply the cost of borrowing money. If the interest is tacked onto your loans, it can become what’s called capitalized interest.

With both federal and private student loans, interest begins accruing immediately. Interest doesn’t go away because you aren’t making payments. Instead the interest you owe adds up over time.

Student loan lenders track your loan balance and any unpaid interest you owe. And at certain times, that interest can “capitalize,” which will cause you to pay even more in interest charges over time. It’s critical to understand how capitalized interest works so that you can manage your student loans effectively. Here’s what you need to know.

What Is Capitalized Interest?

Capitalized interest is interest that you owe, but didn’t pay while you were in school, while your loans were in deferment or forbearance, or while you were on an Income-Driven Repayment (IDR) plan.

Whenever you leave a time of modified payment and re-enter normal repayment, this unpaid interest is added to your principal. That means the unpaid interest goes to $0, and your loan balance goes up by the amount of unpaid interest you owe.

At the point, you officially become responsible for paying off the amount you borrowed plus the unpaid interest charges. So once capitalization happens, you’ll essentially be paying “interest on interest” for the remainder of your loan’s life.

How Does Capitalized Interest Cause Loan Balances To Grow?

Capitalized interest is the reason that student loan balances can grow over time, even if you don’t borrow any more money. Consider a college freshman who borrows $10,000 in unsubsidized direct loans. At an interest rate of 5%, interest on the loan accrues at a rate of $500 per year.

Four years later, when the new graduate begins repaying, they will owe $10,000 + $500 per year in capitalized interest. That means they owe $12,000 instead of the original $10,000 borrowed.

Unpaid interest can also accrue if your monthly loan payment is less than the total amount of interest you owe, which can happen for borrowers on Income-Driven Repayment (IDR) plans. If the borrower doesn’t pay that interest, it will accrue. And if the borrower later leaves the IDR plan, that accrued interest will capitalize and be added to the loan balance.

In the case of federal student loans, interest only capitalizes when the borrower or loan status changes, so it doesn’t compound. By contrast, interest on most private student loans will capitalize monthly.

Does Interest Always Accrue When I’m Not Making Full Payments?

If you have private student loans, you can be fairly certain that interest is accruing and will capitalize when you enter repayment. Federal loans, however, are more complicated.

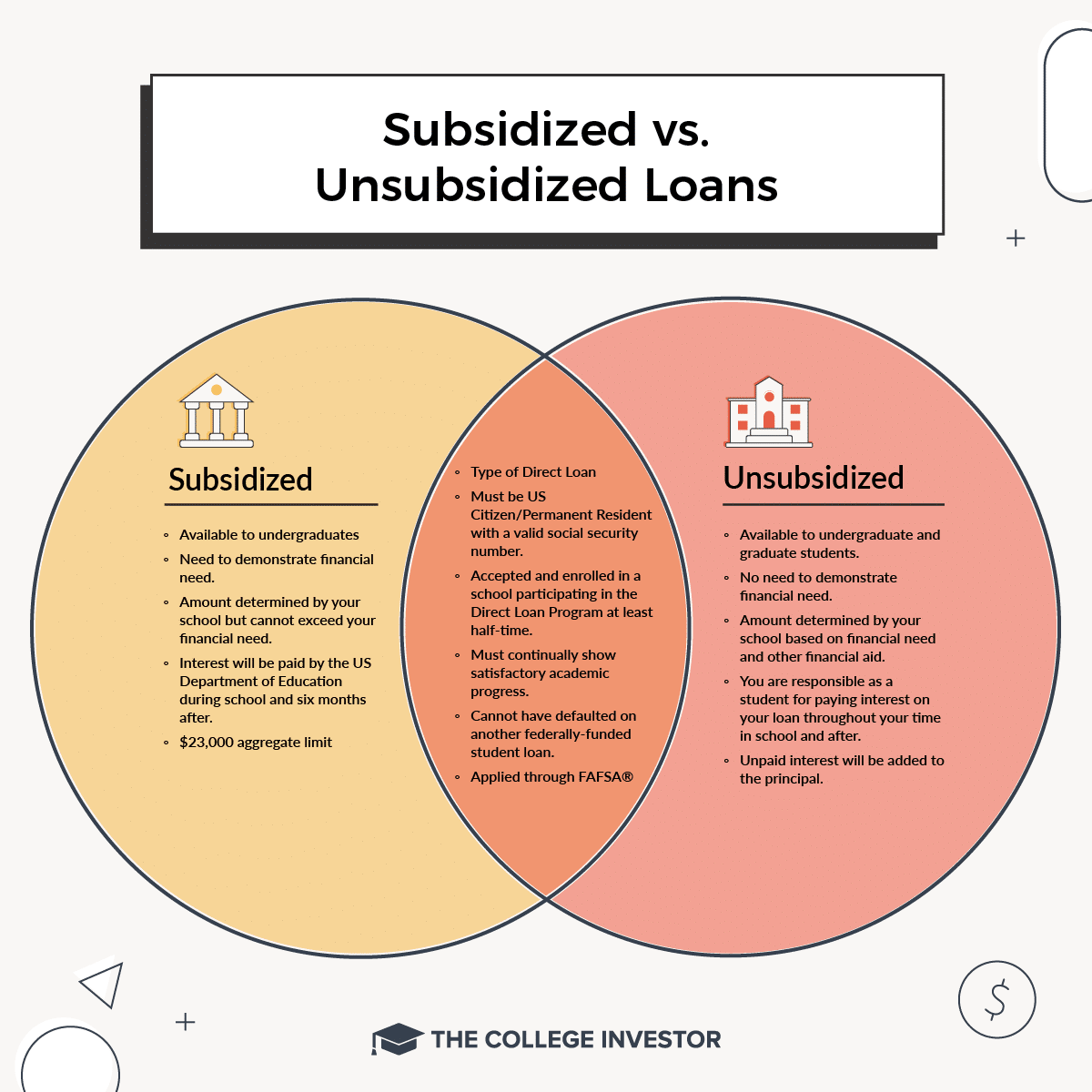

The Department of Education may pay some or all of your unpaid interest in certain situations. For example, the government covers the interest charges on subsidized loans while you are in school and during your 6-month grace period. However, the interest on unsubsidized loans does accrue and will capitalize if not paid before your grace period ends.

The subsidized vs unsubsidized distinction also comes into play if you’re on an IDR plan and your monthly payment is less than the amount accruing on your loans. If you’re on PAYE or IBR plans, the government will pay part or all of the interest that accrues on the loans for up to three years. If you’re on the SAVE repayment plan, capitalized interest doesn’t accrue – your loan balance can never grow.

After 3 years, interest begins to accrue as normal with PAYE and IBR. Learn more about how the Department of Education handles unpaid interest.

Source: The College Investor

When Does Interest Capitalize On Student Loans?

One of the interesting features of student loans is that the interest only capitalizes when the loan changes statuses. Otherwise, the interest continues to accrue in the background without capitalizing. Here are a few actions that could lead to interest capitalization:

- Ending a deferment or forbearance period

- Leaving PAYE or IBR repayment plans.

- Failing to verify your income or family status for IDR plans.

- Consolidating your loans

- Losing eligibility for an IDR plan.

- Moving your loan out of default into repayment.

Should I Try To Avoid Paying Capitalized Interest?

A lot of attention goes into avoiding capitalized interest. But, in some cases, the attention may be misplaced. For example, if you graduate with $25,000 in student loans and all of the interest you accrue during school capitalizes, it will still only add less than $1,000 to your total cost of repayment. Most borrowers would do better to focus on keeping their debt loads down instead of obsessing over avoiding capitalization.

However, if you have a large student loan balance, you may want to pay more attention to minimizing the frequency that your interest is capitalized. It’s better to keep that interest in the “unpaid interest” category rather than committing a capitalizing event. That means you’ll want to avoid switching IDR plans, avoid consolidating loans too often, and keep up to date on your IDR recertification documents.

But if you do have a capitalizing event (such as consolidating your debt or earning too much to qualify for IDR plans), it’s not the end of the world. You’ll simply need to come up with a plan to attack your loans. Popular strategies include making additional payments each month, refinancing your student loans to a lower rate, pursuing forgiveness programs, and more. Learn how to escape student debt!