The coast was clear in terms of top-tier economic releases on Monday, but there was no shortage of major moves among major asset classes.

Check out the headlines that are driving price action.

Headlines:

- Israel’s targeted airstrikes over the weekend avoided Iran’s oil and nuclear facilities

- Japan’s LDP elections pointed to loss of majority for ruling coalition for the first time since 2009

- U.K. CBI realized sales index for October fell from +4 to -6 (-9 forecast)

- China’s CB leading index posted another 0.2% m/m decline in September

- ECB official de Guindos noted that their price outlook is surrounded by substantial risks

- BOC Governor Macklem mentioned that they will have to discover the neutral level of interest rates over time

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

While most asset classes spent the Asian trading session chillin’ in ranges, WTI crude oil gapped lower as traders reacted to news of Israel sparing Iran’s oil and nuclear facilities during their targeted airstrikes.

The energy commodity went on another leg lower at the start of the London session, before levelling off and eventually closing more than 5% lower for the day.

Bitcoin, on the other hand, was having a ball as BTC/USD surged close to all-time highs as investors appeared to be seeking higher returns on “safe-haven” holdings amid the market uncertainty surrounding U.S. elections, Middle East tensions, China’s stimulus and Fed policy. Gold spent the day in the red but managed to trim its losses toward the end of the U.S. session.

Meanwhile, U.S. stock markets seem to be in a cautious yet somewhat positive mood in anticipation of earnings releases from companies like Apple, Meta, Microsoft, Amazon, and Visa later this week.

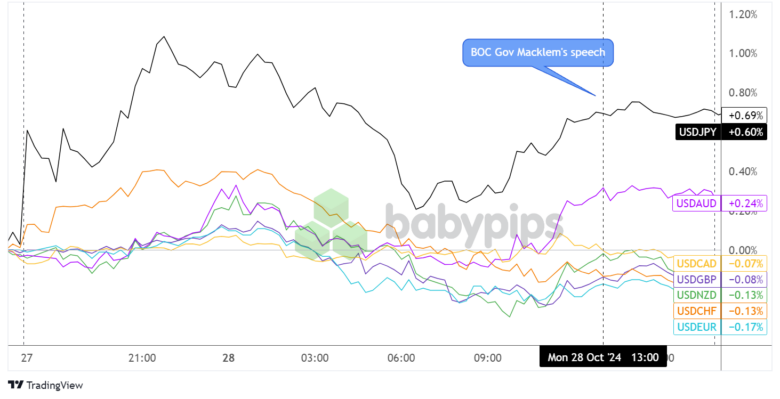

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Major Currencies Chart by TradingView

Major currencies also had a topsy-turvy Monday, particularly the Japanese yen which started off on much weaker footing after the LDP elections revealed that the ruling coalition was unable to secure enough seats for a majority.

This poses a lot of political uncertainty for Japan, as new Prime Minister Ishiba acknowledged the “severe judgment” by voters in light of funding corruption scandals involving senior LDP lawmakers.

USD/CHF had a running start as well, as some risk-off flows propped up the safe-haven dollar during Asian market hours, also against the Aussie and Kiwi. However, the U.S. currency eventually took a turn lower right around the start of the London session before finding a bottom and pulling slightly higher when U.S. markets opened.

Still, major pairs ended mixed, with the dollar ending in the green versus the Aussie and yen while losing pips against the rest of its counterparts.

Upcoming Potential Catalysts on the Economic Calendar:

- German GfK consumer climate index at 7:00 am GMT

- U.S. goods trade balance and preliminary wholesale inventories at 12:30 pm GMT

- U.S. S&P/CS Composite HPI at 1:00 pm GMT

- U.S. CB consumer confidence index at 2:00 pm GMT

- U.S. JOLTS job openings report at 2:00 pm GMT

- SNB Chairman Schlegel’s testimony at 6:00 pm GMT

- BOC Governor Macklem’s speech at 7:30 pm GMT

Brace yourselves for another round of potential dollar volatility, as Uncle Sam is prepping to release the CB consumer confidence index and the first NFP clue for the week: the JOLTS job openings report.

As always, keep an eye out for headlines that impact overall market sentiment, and don’t forget to check out our brand new Forex Correlation Calculator!