Source: The College Investor

Individual Retirement Accounts (IRAs) are self-directed individual retirement plans that offer certain tax advantages.

Many financial institutions offer these plans, and IRA owners can invest in any type of investment that the custodian allows, ranging from simple Certificates of Deposit (CDs) to individual stocks and bonds.

An IRA is one of the best ways to save for retirement, but you need to know the limits!

If you’re looking to open an IRA, check out our list of the Best Places To Open A Roth Or Traditional IRA.

IRA Contribution Deadline

One of the great things about an IRA is that you can contribute to your IRA all the way up until your tax filing deadline for the year.

Here are the current IRA contribution deadlines:

2025 Tax Year: April 15, 2026

2024 Tax Year: April 15, 2025

2025 IRA Contribution Limits

The IRS announced the 2025 IRA contribution limits on November 1, 2024. The limits remain unchanged from 2024, except for the SEP IRA which has a slightly higher total contribution limit.

|

2025 IRA Contribution Limits |

|||

|---|---|---|---|

|

Up to 25% of income or $70,000 |

|||

|

Age 50+ With Catch-Up Contribution |

|||

Data: IRS Notice 2024-80. Source: The College Investor

Note: For a SEP IRA, it’s the lesser of 25% of the first $350,000 of compensation or $70,000.

2025 IRA Income Limits

However, there are income limits to contributing to a Roth or Traditional IRA. These limits did adjust slightly for 2025.

|

2025 Roth IRA Income Limits |

|

|---|---|

|

Phase out starting at $236,000 – $246,000 |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Phase out starting at $150,000 – $165,000 |

|

|

Phase out starting at $150,000 – $165,000 |

|

Remember, if you’re contributing to a traditional IRA, there are different limits whether you have a workplace retirement plan or not.

|

2025 Traditional IRA Income Limits |

|

|---|---|

|

Married, Filing Jointly, With Workplace Plan |

Phase out starting at $126,000 – $146,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Has A Workplace Plan |

Phase out starting at $236,000 – $246,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Doesn’t Have A Workplace Plan |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Single, Not Covered by Workplace Retirement Plan |

|

|

Single, Covered By Workplace Retirement Plan |

Phase out starting at $79,000 – $89,000 |

2024 IRA Contribution Limits

The IRS announced the 2024 IRA contribution limits on November 1, 2023. These limits saw a nice increase, which is due to higher than average inflation. Basically, you can contribute $500 more to your IRA in 2024 (and $3,000 more to a SEP IRA).

|

2024 IRA Contribution Limits |

|||

|---|---|---|---|

|

Up to 25% of income or $69,000 |

|||

|

Age 50+ With Catch-Up Contribution |

|||

Source: The College Investor

Note: For a SEP IRA, it’s the lesser of 25% of the first $345,000 of compensation or $69,000.

2024 IRA Income Limits

However, there are income limits to contributing to a Roth or Traditional IRA. These limits did adjust slightly for 2024, per the IRS.

|

2024 Roth IRA Income Limits |

|

|---|---|

|

Phase out starting at $230,000 – $240,000 |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Phase out starting at $146,000 – $161,000 |

|

|

Phase out starting at $146,000 – $161,000 |

|

Remember, if you’re contributing to a traditional IRA, there are different limits whether you have a workplace retirement plan or not.

|

2024 Traditional IRA Income Limits |

|

|---|---|

|

Married, Filing Jointly, With Workplace Plan |

Phase out starting at $123,000 – $143,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Has A Workplace Plan |

Phase out starting at $230,000 – $240,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Doesn’t Have A Workplace Plan |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Single, Not Covered by Workplace Retirement Plan |

|

|

Single, Covered By Workplace Retirement Plan |

Phase out starting at $77,000 – $87,000 |

Prior Year IRA Contribution Limits

Here’s a list of prior year IRA contribution amounts and limits.

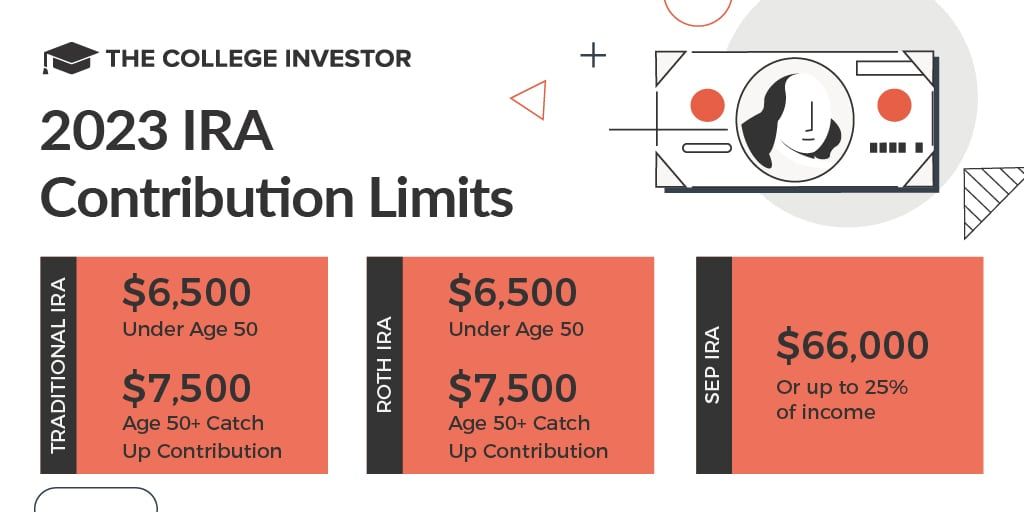

2023 IRA Contribution Limits

The IRS announced the 2023 IRA contribution limits on October 21, 2022. These limits saw a big jump (relatively), which is due to higher than average inflation. Basically, you can contribute $500 more to your IRA in 2023 (and $5,000 more to a SEP IRA).

|

2023 IRA Contribution Limits |

|||

|---|---|---|---|

|

Up to 25% of income or $66,000 |

|||

|

Age 50+ With Catch-Up Contribution |

|||

Source: The College Investor

2023 IRA Income Limits

However, there are income limits to contributing to a Roth or Traditional IRA. These limits did adjust slightly for 2023, per the IRS.

|

2023 Roth IRA Income Limits |

|

|---|---|

|

Phase out starting at $218,000 – $228,000 |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Phase out starting at $138,000 – $153,000 |

|

|

Phase out starting at $138,000 – $153,000 |

|

Remember, if you’re contributing to a traditional IRA, there are different limits whether you have a workplace retirement plan or not.

|

2023 Traditional IRA Income Limits |

|

|---|---|

|

Married, Filing Jointly, With Workplace Plan |

Phase out starting at $116,000 – $136,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Has A Workplace Plan |

Phase out starting at $218,000 – $228,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Doesn’t Have A Workplace Plan |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Single, Not Covered by Workplace Retirement Plan |

|

|

Single, Covered By Workplace Retirement Plan |

Phase out starting at $73,000 – $83,000 |

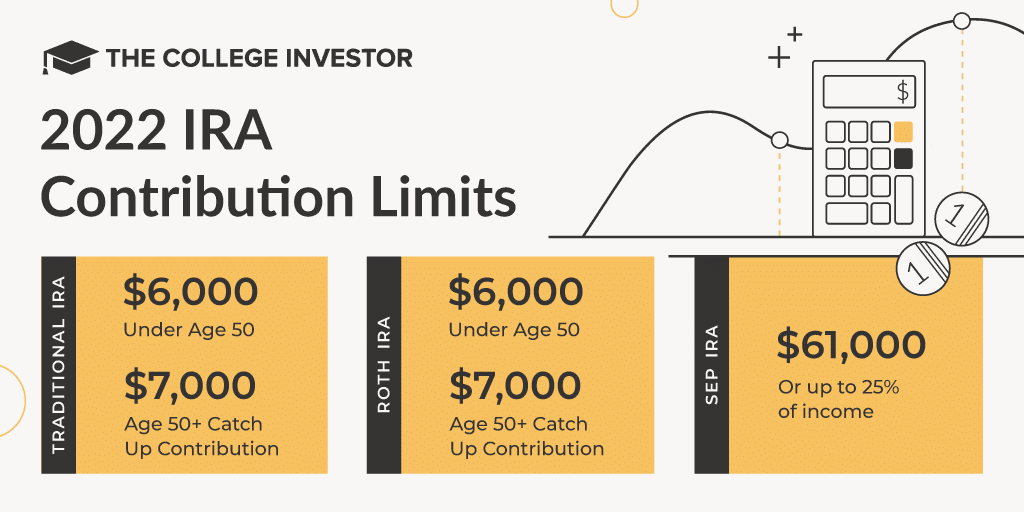

2022 IRA Contribution Limits

The IRS announced the 2022 IRA contribution limits on November 4, 2021. Here’s how much you can contribute for 2022. Note: these limits are the same as 2022 (except for the SEP, which increased by $3,000).

|

2022 IRA Contribution Limits |

|||

|---|---|---|---|

|

Up to 25% of income or $61,000 |

|||

|

Age 50+ Catch Up Contribution |

|||

Source: The College Investor

2022 IRA Income Limits

However, there are income limits to contributing to a Roth or Traditional IRA. These limits did adjust slightly for 2022, per the IRS.

|

2022 Roth IRA Income Limits |

|

|---|---|

|

Phase out starting at $204,000 – $214,000 |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Phase out starting at $129,000 – $144,000 |

|

|

Phase out starting at $129,000 – $144,000 |

|

Remember, if you’re contributing to a traditional IRA, there are different limits whether you have a workplace retirement plan or not.

|

2022 Traditional IRA Income Limits |

|

|---|---|

|

Married, Filing Jointly, With Workplace Plan |

Phase out starting at $109,000 – $129,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Has A Workplace Plan |

Phase out starting at $204,000 – $214,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Doesn’t Have A Workplace Plan |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Single, Not Covered by Workplace Retirement Plan |

|

|

Single, Covered By Workplace Retirement Plan |

Phase out starting at $68,000 – $78,000 |

2021 IRA Contribution Limits

The IRS announced the 2021 IRA contribution limits on October 26, 2020. Here’s how much you can contribute for 2020. Note: these limits are the same as 2020 (except for the SEP, which increased by $1,000).

|

2021 IRA Contribution Limits |

|||

|---|---|---|---|

|

Up to 25% of income or $58,000 |

|||

|

Age 50+ Catch Up Contribution |

|||

2021 IRA Income Limits

However, there are income limits to contributing to a Roth or Traditional IRA. These limits did adjust slightly for 2021, per the IRS.

|

2021 Roth IRA Income Limits |

|

|---|---|

|

Phase out starting at $198,000 – $208,000 |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Phase out starting at $125,000 – $140,000 |

|

|

Phase out starting at $125,000 – $140,000 |

|

Remember, if you’re contributing to a traditional IRA, there are different limits whether you have a workplace retirement plan or not.

|

2021 Traditional IRA Income Limits |

|

|---|---|

|

Married, Filing Jointly, With Workplace Plan |

Phase out starting at $105,000 – $125,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Has A Workplace Plan |

Phase out starting at $198,000 – $208,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Doesn’t Have A Workplace Plan |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Single, Not Covered by Workplace Retirement Plan |

|

|

Single, Covered By Workplace Retirement Plan |

Phase out starting at $66,000 – $76,000 |

2020 IRA Contribution Limits

The IRS announced the 2020 IRA contribution limits on November 6, 2019. Here’s how much you can contribute for 2020. Note: these limits are the same as 2019 (except for the SEP, which rose by $1,000).

|

2020 IRA Contribution Limits |

|||

|---|---|---|---|

|

Up to 25% of income or $57,000 |

|||

|

Age 50+ Catch Up Contribution |

|||

2020 IRA Income Limits

However, there are income limits to contributing to a Roth or Traditional IRA. These limits did adjust for 2020, per the IRS.

|

2020 Roth IRA Income Limits |

|

|---|---|

|

Phase out starting at $196,000 – $206,000 |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Phase out starting at $124,000 – $139,000 |

|

|

Phase out starting at $124,000 – $139,000 |

|

Remember, if you’re contributing to a traditional IRA, there are different limits whether you have a workplace retirement plan or not.

|

2020 Traditional IRA Income Limits |

|

|---|---|

|

Married, Filing Jointly, With Workplace Plan |

Phase out starting at $104,000 – $124,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Has A Workplace Plan |

Phase out starting at $196,000 – $206,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Doesn’t Have A Workplace Plan |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Single, Not Covered by Workplace Retirement Plan |

|

|

Single, Covered By Workplace Retirement Plan |

Phase out starting at $65,000 – $75,000 |

2019 IRA Contribution Limits

The IRS announced the 2019 IRA contribution limits on November 1, 2018. Here’s how much you can contribute for 2019.

|

2019 IRA Contribution Limits |

|||

|---|---|---|---|

|

Up to 25% of income or $56,000 |

|||

|

Age 50+ Catch Up Contribution |

|||

2019 IRA Income Limits

However, there are income limits to contributing to a Roth or Traditional IRA. These limits also adjusted in 2019.

|

2019 Roth IRA Income Limits |

|

|---|---|

|

Phase out starting at $193,000 – $203,000 |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Phase out starting at $122,000 – $137,000 |

|

|

Phase out starting at $122,000 – $137,000 |

|

Remember, if you’re contributing to a traditional IRA, there are different limits whether you have a workplace retirement plan or not.

|

2019 Traditional IRA Income Limits |

|

|---|---|

|

Married, Filing Jointly, With Workplace Plan |

Phase out starting at $103,000 – $123,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Has A Workplace Plan |

Phase out starting at $193,000 – $203,000 |

|

Married, Filing Jointly, Without Workplace Plan, But Spouse Doesn’t Have A Workplace Plan |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Single, Not Covered By Workplace Retirement Plan |

|

|

Single, Covered By Workplace Retirement Plan |

Phase out starting at $64,000 – $74,000 |

2018 IRA Contribution Limits

Here are the 2018 IRA contribution limits. Remember, you can make your contribution all the way until April 15.

|

Up to 25% of income or $55,000 |

|||

|

Age 50+ Catch Up Contribution |

2018 IRA Income Limits

It’s important to remember that you can only contribute to a traditional or Roth IRA if you meet certain income limits. If you exceed these limits, you can look at a non-deductible IRA (which can be used with a backdoor Roth IRA if you want to).

|

2018 Roth IRA Income Limits |

|

|---|---|

|

Phase out starting at $189,000 – $199,000 |

|

|

Married, Filing Separately |

Phase out starting at $0 – $10,000 |

|

Phase out starting at $120,000 – $135,000 |

|

Anyone with earned income and younger than 70 1/2 can contribute to a traditional IRA, but tax deductibility is based on income limits and participation in an employer plan.

What Happens If You Contributed Too Much or Made Too Much?

If you contributed to much, you will need to call your IRA provider and withdraw the excess contribution.

If you made too much money to qualify for an IRA, you would need to do an IRA re-characterization. You can call your IRA company and they can walk you through the process.

Types Of IRAs

Two types of IRAs, Traditional and Roth IRAs, allow employees to control and make contributions to on their own, while the third type of IRA, the SEP IRA, is distinct in being an employer-provided benefit. Below is an overview of each of these three types.

If you don’t know which is best for you, check out this guide: The Ultimate Guide To Roth vs Traditional IRA Contributions.

Traditional IRAs

Traditional IRAs are tax-deductible (as long as the owner’s income does not exceed certain limits) and tax-deferred retirement accounts, meaning that annual contributions to the IRA are not taxed at the time of contribution and are instead taxed when money is withdrawn.

This may be a good choice for investors who expect to be at a lower income tax bracket in the future (or investors who believe future tax brackets will be lower in general, even if they believe they will be making the same amount of money).

Roth IRAs

Roth IRAs are post-tax retirement accounts, meaning that money contributed to the account has already been taxed.

However, both the amount contributed and future earnings on the investments in the account may be withdrawn without paying further taxes. This may be an advantageous choice for investors who believe they will be in a higher tax bracket in the future.

SEP IRAs

Simplified Employee Pension (SEP) IRAs are used by business owners and must also be offered to all qualifying employees, if there are any.

Employees that are at least 21, who have worked for that employer for three or more years out of the previous five, and who have earned at least $750 (the limit for both 2023 and 2024) for that year qualify to participate in the plan.

Only employers may contribute to a SEP IRA, though they are not locked into making certain annual contributions the same way a 401(k) plan might be.

Withdrawals From IRAs

IRAs, because they are designed to provide for people during their retirement years, impose restrictions on withdrawing funds before retirement age, which is defined as age 59½ or complete and total disability.

If the withdrawal does not meet the requirements for a qualifying exception to these provisions, a 10% penalty will apply to the amount withdrawn.

Final Thoughts

Using either a Traditional or Roth IRA (whichever makes most sense in your tax situation) is an excellent tool in addition to any retirement plan your employer offers, including 401(k) plans and SEP-IRAs.

Individuals should attempt to make the maximum contribution allowed to their Traditional and/or Roth IRAs annually to take full advantage of the tax savings available.

Do you have an IRA? What will you do to try to max out retirement contributions?