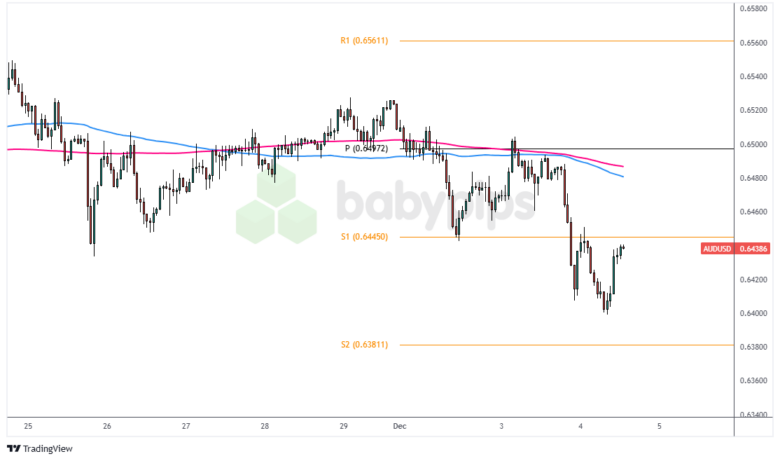

Today’s weaker-than-expected Australian GDP print potentially sets up AUD/USD for continued downside moves in the short-term.

With headline growth coming in at just 0.3% versus 0.4% expected, and GDP per capita falling for a seventh straight quarter, the odds of RBA rate cuts in early 2025 appear to be increasing rapidly.

Let’s examine how we may theoretically structure a trade plan around this development.

This Article Is For Premium Members Only

Become a Premium member for full website access, plus get:

- Ad-free experience

- Daily actionable short-term strategies

- High-impact economic event trading guides

- Access to exclusive MarketMilk™ sections

- Plus More!