Bitcoin hit a key milestone on Thursday even as the rest of the major assets saw pullbacks or stayed in wide ranges.

Meanwhile, the U.S. dollar extended its losses ahead of Friday’s U.S. jobs reports.

Which headlines influenced market price action yesterday? We have the deets:

Headlines:

- Bitcoin traded above $100K and hit $104K before pulling back down

- Australia’s goods trade surplus widened to 5.95B AUD as exports rose 3.6% while imports rose 0.1%

- Switzerland unemployment rate steady at 2.6% in Nov (2.7% expected)

- Germany factory orders down 1.5% m/m in Oct (-2.0% expected, previous reading upgraded from 4.2% to 7.2%)

- BOE survey showed companies expect year-ahead inflation to come in at 2.7% in November, faster than the 2.6% rate in October

- France industrial production improved from -0.8% m/m to -0.1% m/m in October (0.2% expected, September reading revised from -0.9%)

- U.K. construction PMI for Nov up from 54.3 to 55.2 vs. 53.5 forecast, despite dip in new order growth

- Eurozone retail sales down 0.5% m/m in Oct (-0.3% expected, +0.5% previous)

- OPEC+ agreed to implement output hike in three tranches, starting April 2025

- U.S. Challenger job cuts in Nov: +26.8% y/y vs. 50.9% previous, 57K in cuts for the month

- U.S. weekly initial jobless claims for week ending Nov 28: 224K (215K expected & previous)

- U.S. trade deficit narrowed from 83.8B USD to 73.8B USD (expected 75.2B USD shortfall) as exports fell 1.6% and imports dropped 4% in Oct

- Canada trade deficit shrank from 1.3B CAD to 0.9B CAD (1.0B CAD deficit expected) in October as exports (+1.1%) outpaced imports (+0.5%)

- BOE member Megan Greene thinks “consumption will take a while to recover” as some consumers get stuck with high mortgage rates

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Most major assets stayed in a holding pattern on Thursday as traders geared up for Friday’s U.S. labor market data.

Bitcoin stole the spotlight, smashing past the $100K milestone and briefly hitting $104K before cooling off to $97K. The surge came after Trump revealed plans to nominate Paul Atkins—known for his pro-crypto and pro-deregulation stance—to lead the SEC.

U.S. 10-year Treasury yields and the dollar stayed soft, with traders still banking on a December Fed rate cut. Even so, gold and U.S. stocks slipped from their weekly highs, likely due to some profit-taking ahead of the NFP release.

Over in energy markets, OPEC+ decided to push back the unwinding of their output cuts by three months. The move was no surprise, which probably explains why U.S. crude prices stayed below $69.00.

FX Market Behavior: U.S. Dollar vs. Majors:

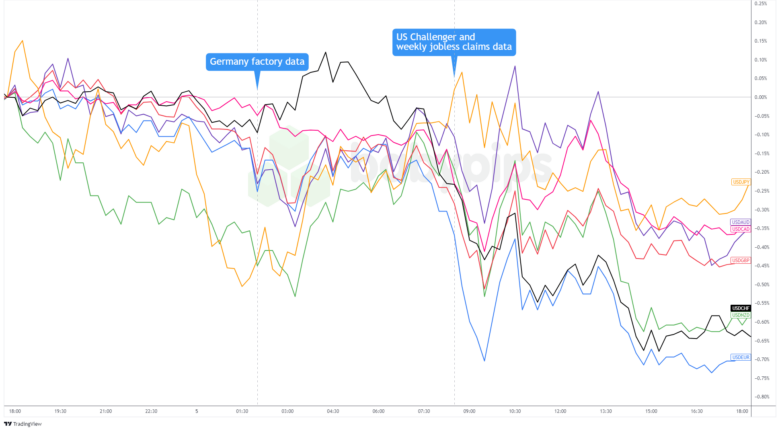

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar extended its losses ahead of Friday’s jobs report. USD/JPY dropped 70 pips after BOJ member Toyoaki Nakamura, known for his dovish stance, signaled he’s open to a potential rate hike.

The dollar slid further during early European trading as Germany’s factory orders fell less than expected and political uncertainty in France eased, providing some relief to the eurozone outlook.

The Greenback saw a brief recovery just before the U.S. session but couldn’t sustain the momentum. The Challenger job cuts and weekly jobless claims reports didn’t shake expectations for a December Fed rate cut, and weak U.S. 10-year yields kept the pressure on.

By the close, the dollar was broadly weaker. It took the biggest hits against the euro, Swiss franc, and Kiwi, while losses against the yen, Aussie, and Loonie were more modest.

Upcoming Potential Catalysts on the Economic Calendar:

- Germany industrial production data at 7:00 am GMT

- Germany trade balance at 7:00 am GMT

- U.K. Halifax HPI at 7:00 am GMT

- France trade balance at 7:45 am GMT

- European final employment change at 10:00 am GMT

- Italian retail sales at 10:00 am GMT

- European revised GDP at 10:00 am GMT

- Canada labor market data at 1:30 pm GMT

- U.S. NFP reports at 1:30 pm GMT

- FOMC member Bowman to give a speech at 2:15 pm GMT

- U.S. preliminary UoM consumer sentiment and inflation expectations at 3:00 pm GMT

- Canada Ivey PMI at 3:30 pm GMT

- FOMC member Goolsbee to give a speech at 3:30 pm GMT

- FOMC member Hammack to give a speech at 5:00 pm GMT

- FOMC member Daly to give a speech at 6:00 pm GMT

Today’s economic calendar is packed with high-impact events across major economies, featuring German industrial data, employment figures from Canada and the U.S., and inflation-related indicators that could significantly move currency pairs.

Market volatility could peak during the North American session, with multiple U.S. labor market releases at 1:30 pm GMT, followed by a parade of Fed speakers including Bowman, Goolsbee, Hammack, and Daly, who may provide insights into the Fed’s monetary policy stance.

Make sure you’re glued to the tube in case we see increased volatility during their events, and don’t forget to check out our Currency Correlation tool when taking any trades!