Data from S&P Global showed economic growth accelerating in December, though with significant divergence between sectors.

The services sector saw dramatic expansion, with PMI rising to 58.5 from 56.1, marking a 38-month high. If pandemic months are excluded, this was the strongest expansion recorded since March 2015.

Meanwhile, the goods-producing manufacturing sector weakened further with PMI falling to 48.3 from 49.7, marking its third consecutive decline and recording the steepest deterioration in manufacturing output since May 2020.

- Flash manufacturing PMI for December: 48.3 (49.7 previous, 3-month low)

- Flash services PMI for December: 58.5 (56.1 previous, 38-month high)

- Flash composite PMI for December: 56.6 (54.9 previous, 33-month high)

The report highlighted strengthening demand conditions overall, with new orders rising at the sharpest rate since April 2022. However, this growth was heavily concentrated in services, while manufacturing new orders fell for a sixth consecutive month.

Employment showed positive movement in December, with jobs increasing for the first time in five months. This reflected a second consecutive monthly rise in manufacturing jobs and the first increase in service sector employment since July. However, the increases in both sectors remained modest, indicating ongoing caution in hiring.

Price pressures showed divergent trends, with manufacturing seeing a spike in raw material costs while services sector costs grew at the slowest pace in four-and-a-half years. Overall selling price inflation reached its lowest level since prices began rising in June 2020.

Link to S&P Global U.S. Flash PMIs for December

The Composite PMI report showed that business confidence reached the highest level since May 2022, marking a significant improvement from September’s pre-election low. However, some manufacturers expressed concern about weak demand and the potential impacts of future tariffs.

Market Reactions

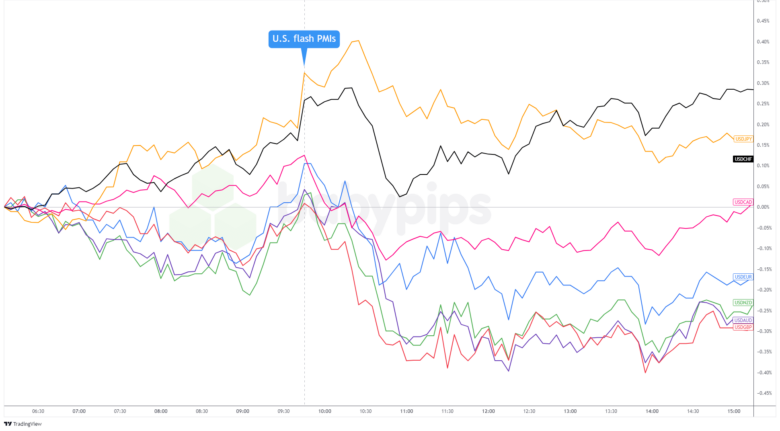

U.S. dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar started the U.S. session on a strong note and got an extra boost after upbeat services sector data.

But the rally didn’t last long. Traders quickly shifted focus to the near certainty of a Fed rate cut later this week. A dovish outlook, along with some profit-taking ahead of the big decision, pushed the dollar broadly lower.

By the end of the day, the dollar was trading near its session lows and turned in a mixed performance. It closed higher against the Swiss franc, yen, and Canadian dollar but lost ground against the other major currencies.