The Institute for Supply Management’s services sector gauge expanded at a faster pace in December, with the headline index rising to 54.1 from November’s 52.1 reading versus the 53.5 market consensus.

More notably, the prices component saw its sharpest monthly increase in nearly a year, setting implications for the Fed’s monetary policy easing path for 2025.

Key points from the ISM report:

- Business Activity Index rose to 58.2%, up 4.5 points from November

- New Orders Index edged higher to 54.2% from 53.7%

- Employment Index remained in expansion at 51.4%

- Prices Paid Index jumped 6.2 points to 64.4%, its highest since January

- Supplier Deliveries returned to expansion at 52.5%

Link to ISM Services PMI Report (December 2024)

The services sector chalked up its sixth consecutive month of growth, marking expansion in 52 of the last 55 months since the pandemic recovery began.

Nine industries reported growth in December, though this was five fewer than in November. Survey respondents noted increasing concerns about potential tariffs while others highlighted that end-of-year and seasonal factors helped drive business activity.

The robust services sector reading, particularly the jump in price pressures, had traders repricing expectations for Fed rate cuts. Fed funds futures now show just a 44.8% probability of a 25bp cut by June while the CME FedWatch tool shows a slightly higher 95.2% chance of the central bank standing pat in their January meeting.

Market Reactions

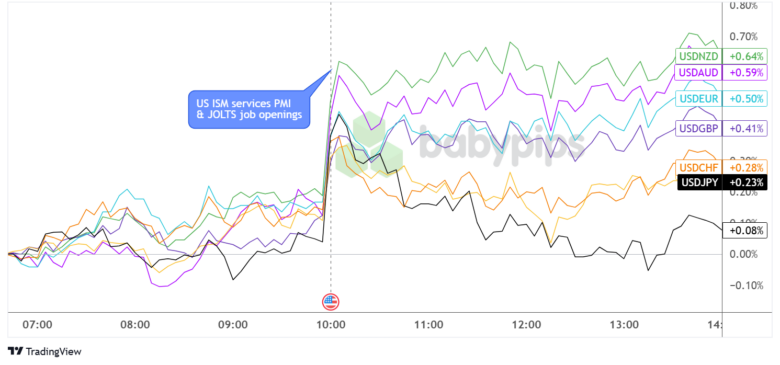

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar initially strengthened across the board following the release as traders likely focused on the expansion in business activity and sharp rise in price pressures.

Part of the dollar’s gains can also be attributed to the upbeat JOLTS job openings figure of 8.10 million in November, representing an increase over the earlier 7.84 million (upgraded from the initial 7.74 million reading).

However, a bit of selling pressure emerged, particularly for USD/CHF, USD/CAD, and USD/JPY, as markets digested concerns about employment and potential tariff impacts mentioned in the report. Still, the Greenback managed to close the session in the green across the board, holding on to majority of its gains vs. AUD and NZD.