China’s consumer prices slowed from 0.2% year-on-year in November to 0.1% in December 2024, while producer prices continued their decline, reinforcing concerns about deflationary pressures in the world’s second-largest economy.

Key points from the National Bureau of Statistics:

- Consumer Price Index (CPI) rose 0.1% year-on-year in December, down from 0.2% in November

- Core CPI, excluding food and energy, increased 0.4% from a year ago

- Producer Price Index (PPI) fell 2.3% year-on-year, marking the 27th straight month of decline

- Food prices decreased 0.6% month-on-month, with pork prices dropping 2.1%

Link to China’s CPI and PPI data (December 2024)

The latest figures highlight China’s ongoing struggle with weak domestic demand despite various stimulus measures introduced since September, including interest rate cuts and increased bank lending.

The near-zero consumer inflation and prolonged producer price losses suggest that Beijing’s efforts to boost consumption have yet to gain significant traction.

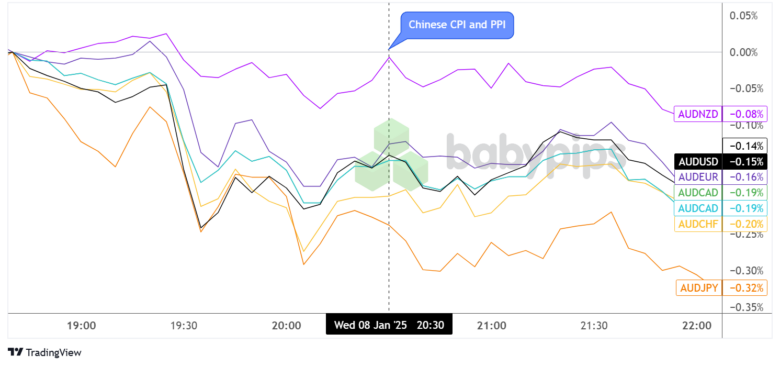

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart by TradingView

The Australian dollar, which often serves as a proxy for China’s economic health, weakened across the board following the release. Initial selling pressure emerged during the Asian session, with AUD falling notably against JPY (-0.32%) and CHF (-0.20%).

The currency pair showed some resilience against its other major counterparts, limiting losses against USD (-0.15%) and NZD (-0.08%). After all, the Kiwi’s price movements are also indirectly tied to China’s economic performance and commodity demand outlook.