With the U.S. out on a bank holiday, traders focused on global headlines and the possibility of increased defense spending by NATO allies amid Russia-Ukraine peace talk preparations.

How did the major assets trade on Monday?

Let’s break down the headlines:

Headlines:

- Japan preliminary GDP for Q4 2024: 0.7% q/q (0.3% forecast, 0.3% previous); Price Index accelerated from 2.4% y/y to 2.8% y/y

- U.K. Rightmove house price index for February gained 0.5% m/m after 1.7% increase in January

- European defense stocks rose on NATO remarks on military spending boost

- Euro Area trade surplus widened from €13.3B to €14.6B as imports (-0.8% m/m) fell faster than exports (-0.2% m/m) in December

- Russian Deputy Prime Minister Alexander Novak denied claims that OPEC+ is considering delaying its oil supply increases in April

- FOMC member Patrick Harker advocated for steady rates amid inflation progress

- FOMC member Christopher Waller favors pausing rate cuts until inflation bump fades

- FOMC member Michelle Bowman wants to “gain greater confidence” in lowering inflation before cutting rates further

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

With U.S. markets closed for Presidents’ Day, global headlines took center stage. A big mover was Japan, where Q4 GDP surged 2.8%—well above the 1.0% forecast—sending the yen higher and nudging U.S. Treasury yields up in thin trading.

European stocks hit fresh records, with the Stoxx 600 climbing as defense stocks surged. An emergency summit in Paris fueled the rally, sparked by reports of U.S.-Russia talks on Ukraine that excluded European leaders. Despite the holiday, S&P 500 futures inched higher, while the dollar index firmed.

Oil prices rose in a tug-of-war between peace hopes from U.S.-Russia discussions and concerns over NATO’s future as European leaders debated regional security. Gold clawed back some losses after Friday’s plunge, while Bitcoin held steady above $95,000 in a quiet session. Meanwhile, U.S. 10-year yields ticked higher in offshore trading after last week’s sharp drop on weak retail sales data.

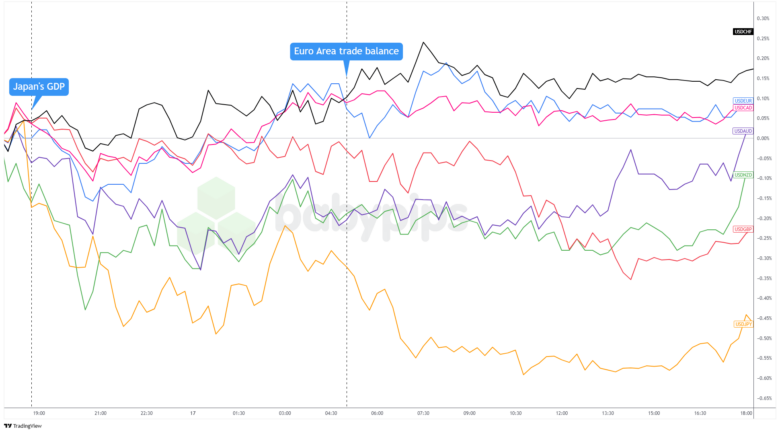

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Major Currencies Chart by TradingView

The dollar started the week on the back foot but managed a modest recovery as the day progressed. In Asian trading, it came under broad pressure after Japan’s GDP blew past expectations, fueling bets on faster BOJ tightening. The impact was sharpest against the yen, though the dollar softened across most major currencies in the early hours.

As European markets opened, the greenback found some stability, helped by a weaker-than-expected Eurozone trade balance. Despite thin holiday conditions, the dollar’s recovery was steady but measured through the session.

With U.S. markets closed for Presidents’ Day, the afternoon session was quiet, though the dollar trimmed some of its earlier losses. The day’s price action was largely driven by Japan’s GDP surprise, while holiday-thinned trading and caution ahead of U.S.-Russia talks on Ukraine kept broader moves in check.

Upcoming Potential Catalysts on the Economic Calendar:

- U.K. labor market numbers at 7:00 am GMT

- France final CPI at 7:45 am GMT

- U.K. BOE Governor Bailey to give a speech at 9:30 am GMT

- Eurozone German ZEW economic sentiment at 10:00 am GMT

- Eurozone ZEW economic sentiment at 10:00 am GMT

- Canada CPI reports at 1:30 pm GMT

- U.S. Empire State manufacturing index at 1:30 pm GMT

- U.S. NAHB housing market index at 3:00 pm GMT

- FOMC member Daly to give a speech at 3:20 pm GMT

- FOMC member Barr to give a speech at 6:00 pm GMT

- New Zealand PPI reports at 9:45 pm GMT

- Australia MI leading index at 11:30 pm GMT

- Japan core machinery orders at 11:50 pm GMT

- Japan trade balance at 11:50 pm GMT

The European session could see GBP movement with U.K. labor data and a speech from BOE Governor Bailey, while the Eurozone ZEW sentiment reports may shape market sentiment in the region.

In the U.S. session, Canada’s inflation data and comments from Fed officials Daly and Barr might drive CAD and USD price action, depending on how they impact rate expectations.

Markets could also stay on edge as traders watch for updates on the Russia-Ukraine peace talks and NATO discussions, which may influence risk appetite and safe-haven demand.

Don’t forget to check out our brand new Forex Correlation Calculator when taking any trades!