Trade war was the name of the game on Tuesday, as Trump’s tariff plans took effect and Uncle Sam’s major trading partners imposed retaliatory tariffs on the world’s largest economy.

Which assets saw increased volatility in the last trading sessions?

Let’s discuss:

Headlines:

- U.K. BRC shop price index for February: -0.7% y/y (-0.5% forecast, -0.7% previous)

- Australia Retail Sales MoM for January 2025: 0.3% (0.4% forecast; -0.1% previous)

- Japan Consumer Confidence for February 2025: 35.0 (35.7 forecast; 35.2 previous)

- Euro area Unemployment Rate for January 2025: 6.2% (6.3% forecast; 6.3% previous)

- U.S. RCM/TIPP Economic Optimism Index for March 2025: 49.8 (53.0 forecast; 52.0 previous)

- The U.S. imposed 25% tariffs on Mexican and Canadian imports (10% on Canadian energy) and doubled tariffs on Chinese products to 20%, hinted at reciprocal tariffs by April 2

- China announced 15% tariffs on U.S. chicken, wheat, corn and cotton, plus 10% tariffs on soybeans, pork, beef and dairy beginning March 10

- Canada imposed 25% tariff on $30B CAD worth of U.S. goods, with plans to expand those tariffs to cover $125B CAD in imports within three weeks

- Mexico to announce new tariffs on Sunday

- FOMC voting member John Williams expects Trump’s tariffs to drive inflation higher

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The major assets took hits on Tuesday as Trump’s latest tariffs kicked in – 25% on Canadian and Mexican imports (10% on Canadian energy) and a bump to 20% on Chinese goods.

The trade war escalated fast, with Canada slapping a 25% tariff on $20.7 billion of US goods and planning to target another $125 billion soon. China followed up with 10-15% tariffs on US agricultural products starting March 10, while Mexico is holding off its response until Sunday.

Gold climbed 0.67% to $2,915 as investors sought safety, while bitcoin jumped to $87,800 after early swings. U.S. oil prices dipped to $66.75 before settling at $68.00 as demand concerns and increased OPEC+ production weighed on prices.

Global stocks took a beating, with the S&P 500 sliding 1.2% to a four-month low of 5,776.15 and Germany’s DAX sinking 2.61%. Bargain hunters briefly stepped in, but risk aversion won out. 10-year U.S. Treasury yields initially dropped to 4.106% before bouncing back to 4.21% as early safe-haven flows turned into profit-taking.

The CME FedWatch Tool now estimates THREE Fed rate cuts for 2025 as worries grow over how the trade war could hit global growth and inflation.

FX Market Behavior: U.S. Dollar vs. Majors:

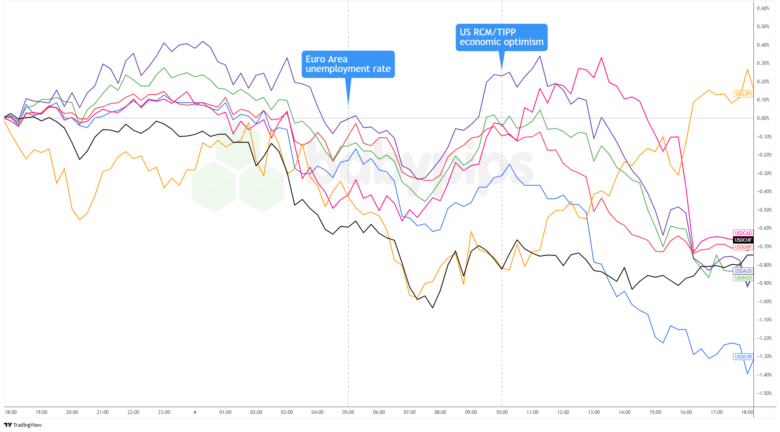

Overlay of USD vs. Major Currencies Chart by TradingView

The dollar slid across the board Tuesday as Trump’s tariffs took effect, with the dollar index dropping 0.8% to 105.88. Escalating trade tensions fueled worries about US growth, keeping the greenback under pressure throughout the day.

The dollar started strong but lost ground after China’s commerce ministry warned of countermeasures, sending USD/JPY below 149.00 as safe-haven flows lifted the yen. The European session saw dollar weakness pick up, especially after the Eurozone unemployment rate held steady at 6.2%. The Greenback briefly ticked higher before the US session, likely due to positioning adjustments and bargain hunting, but the move did not last.

The selloff deepened during U.S. trading as markets absorbed the tariff implications. Sentiment steadied for a moment around the U.S. session open and the RCM/TIPP economic optimism release, but pressure quickly returned. The dollar fell to a one-week low against the yen and a six-day low against the euro. A mid-session recovery attempt driven by profit taking on shorts faded toward the close as fresh retaliatory tariffs reignited concerns about a full-blown trade war.

Upcoming Potential Catalysts on the Economic Calendar:

- Switzerland CPI at 7:30 am GMT

- France industrial production at 7:45 am GMT

- Spain services PMI at 8:15 am GMT

- Italy services PMI at 8:45 am GMT

- France final services PMI at 8:50 am GMT

- Germany final services PMI at 8:55 am GMT

- Euro Area final services PMI at 9:00 am GMT

- U.K. final services PMI at 9:30 am GMT

- Euro Area PPI at 10:00 am GMT

- U.S. ADP report at 1:15 pm GMT

- Canada labor productivity at 1:30 pm GMT

- U.S. final services PMI at 2:45 pm GMT

- U.S. ISM services PMI at 3:00 pm GMT

- U.S. factory orders at 3:00 pm GMT

- U.S. crude oil inventories at 3:30 pm GMT

- U.S. Beige Book report at 7:00 pm GMT

- New Zealand RBNZ Governor Orr to give a speech at 8:30 pm GMT

Over the next few hours, European PMI reports might shake up the euro and pound, while U.S. traders will be watching ADP jobs data and the ISM services PMI to gauge what’s next for the Fed and the dollar.

Oh, and don’t forget that any big geopolitical or trade headlines could stir up overall market sentiment. Make sure you’re glued to the tube for any market-moving updates!

Don’t forget to check out our brand new Forex Correlation Calculator when taking any trades!