Market participants woke up on the wrong side of the bed, greeted by deflation concerns in China and worries about a U.S. recession.

Risk assets like U.S. equity indices and crude oil closed in the red while the U.S. dollar also found itself in negative territory.

Here’s a breakdown of the biggest moves and movers in the last trading sessions:

Headlines:

- U.S. President Trump signed an executive order for a strategic bitcoin reserve, which will be funded by coins seized in criminal and civil cases

- China Inflation Rate YoY for February 2025: -0.7% (-0.4% forecast; 0.5% previous); China Inflation Rate MoM for February 2025: -0.2% (0.0% forecast; 0.7% previous)

- China PPI YoY for February 2025: -2.2% (-2.0% forecast; -2.3% previous)

- Japan Average Cash Earnings YoY for January 2025: 2.8% (3.5% forecast; 4.8% previous)

- Japan Bank Lending YoY for February 2025: 3.1% (3.0% forecast; 3.0% previous)

- Japan Current Account for January 2025: -257.6B (-70.0B forecast; 1,077.3B previous)

- Japan Leading Economic Index Prel for January 2025: 108.0 (108.7 forecast; 108.3 previous)

- Japan Eco Watchers Survey Outlook for February 2025: 46.6 (48.6 forecast; 48.0 previous)

- Germany Industrial Production MoM for January 2025: 2.0% (1.5% forecast; -2.4% previous)

- Germany Balance of Trade for January 2025: 16.0B (21.5B forecast; 20.7B previous); exports down 2.5% while imports rose 1.2%

- Swiss Consumer Confidence for February 2025: -34.0 (-27.0 forecast; -29.0 previous)

Broad Market Price Action:

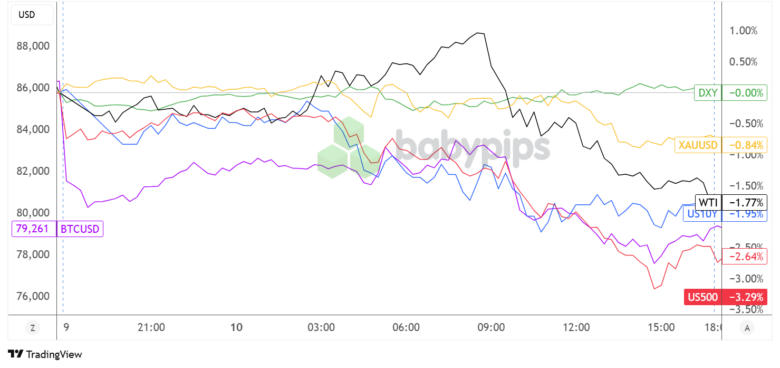

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The mood was pretty somber as markets opened on Monday, with traders digesting weekend releases and last Friday’s developments.

As it turned out, U.S. President Trump’s executive order establishing a strategic crypto reserve weighed heavily on bitcoin and other cryptocurrencies, keeping BTC/USD in selloff mode throughout the day. Details revealed that the government plans to use bitcoin seized from criminal cases to fund the reserve instead of buying new coins from the market.

Meanwhile, China printed downbeat CPI and PPI figures over the weekend, leading market watchers to worry about potential deflation in the country, keeping crude oil on the back foot. It didn’t help that investors also started buzzing about a possible U.S. recession on account of elevated inflation and high interest rates constraining spending and investment.

Gold, which started the day on positive footing thanks to safe-haven flows, also turned lower to close 0.84% in the red. Treasury yields were also on shaky ground, as traders likely sought the safety of government bonds.

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Major Currencies Chart by TradingView

The Greenback had a mixed start, as it struggled to hold its ground versus riskier currencies like the Aussie and Kiwi on account of downbeat Chinese inflation data, but was under downside pressure against safe-haven rivals, CHF and JPY.

A broader selloff was seen a few hours into the London session, as U.S. recession jitters appeared to kick in, before the lower-yielding U.S. currency soon took advantage of risk-off flows. Analysts pointed out that the initial enthusiasm for Trump’s deregulation plans and tax cuts was starting to fade, putting the spotlight back on the inflationary impact of higher U.S. tariffs.

Still, USD/JPY (-0.52%) was unable to pull back to positive territory while USD/CHF (-0.03%) was able to trim losses.

Upcoming Potential Catalysts on the Economic Calendar:

- Japanese preliminary machine tool orders at 6:00 am GMT

- U.S. NFIB Small Business Index at 10:00 am GMT

- U.S. JOLTS job openings at 2:00 pm GMT

- Japan’s BSI manufacturing index and PPI at 11:50 pm GMT

There’s still not much in the way of top-tier data releases for today, likely keeping overall market sentiment as the main driving factor of price action.

With that, stay on the lookout for headlines concerning U.S. tariffs and retaliatory measures from trade partners, as well as further concerns about a potential recession. Keep your eyes and ears peeled for geopolitical tensions as well.

Don’t forget to check out our brand new Forex Correlation Calculator when taking any trades!