The Federal Reserve’s March 18-19 meeting minutes unveiled a Committee walking a tightrope between inflation concerns and growth risks amid heightened trade policy uncertainty.

The minutes reveal a Fed increasingly concerned about a potential stagflationary environment where higher tariffs boost inflation while simultaneously slowing economic growth. This places policymakers in a difficult position, as the traditional response to higher inflation (tighter policy) conflicts with the typical approach to slower growth (looser policy).

The Committee also decided to slow quantitative tightening by reducing the monthly Treasury securities redemption cap from $25 billion to $5 billion.

Here are key points from the release:

- Almost all participants viewed risks to inflation as tilted to the upside and risks to employment as tilted to the downside

- Officials cut their growth forecasts and raised their inflation outlook for 2025

- The Committee trimmed projected rate cuts for the year from three to two

- Several members noted that their contacts were already reporting cost increases in anticipation of tariffs

- Some participants cautioned about “difficult tradeoffs” if inflation proved persistent while growth weakened

- The Committee decided to slow Quantitative Tightening by reducing Treasury securities redemption cap from $25B to $5B

- Governor Waller opposed slowing the balance sheet runoff, preferring to maintain the previous pace

- Members emphasized they were well-positioned to respond to either persistent inflation or economic weakness

Link to FOMC Meeting Minutes (March 2025)

The decision to slow balance sheet reduction was primarily driven by debt ceiling concerns, with officials worried that reserve scarcity could emerge with little warning once the debt ceiling is resolved and the Treasury begins rebuilding its account. This suggests the Fed is taking a more cautious approach to its quantitative tightening program, though most officials emphasized this should not be interpreted as a change in the monetary policy stance.

The Fed’s reduction of projected rate cuts from three to two for 2025 signals a more patient approach to easing and suggests the Committee is willing to keep policy restrictive for longer if inflation remains elevated. This more hawkish stance contrasts with market expectations earlier in the year for more aggressive easing.

Market Reactions

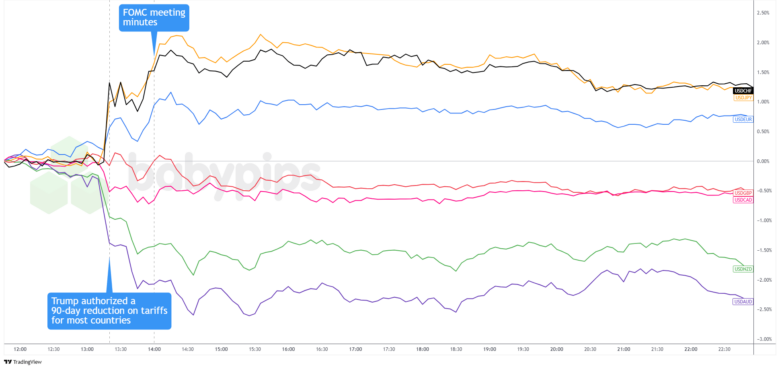

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar caught a quick boost after the FOMC meeting minutes dropped, snapping out of its slump following Trump’s move to ease Liberation Day tariffs (except against China). The bounce likely came from the Fed signaling fewer rate cuts this year than it had previously penciled in.

But the rally did not last long. Between ongoing tariff drama and the Fed flagging stagflation risks, dollar bulls quickly lost their momentum. The Greenback drifted around for the rest of the session before settling into some tight ranges.

Since the FOMC minutes release, the dollar has been on the back foot, slipping across the board except against the oil-linked Canadian dollar, which has not been getting much love either.