Gold surged to fresh record highs while the U.S. dollar tanked across the board following a weak CPI print and lingering trade tension with China.

European stocks rallied hard on Trump’s tariff pause, but U.S. equities gave back some gains as yield spikes and inflation fears rattled sentiment.

Here are major headlines and asset moves you may have missed in the last trading sessions:

Headlines:

- U.K. RICS house price balance for March: 2.0% (10.0% forecast; 11.0% previous)

- Japan PPI for March: 4.2% y/y (4.2% forecast; 4.0% previous); 0.4% m/m (0.3% forecast; 0.0% previous)

- Australia Melbourne Institute consumer inflation expectations for April: 4.2% (3.6% forecast; 3.6% previous)

- RBA Governor Bullock played down the probability of an outsized rate cut for May due to trade war

- China consumer price index for March: -0.4% m/m (-0.4% forecast; -0.2% previous); -0.1% y/y (0.0% forecast; -0.7% previous)

- China producer price index for March: -2.5% y/y (-2.0% forecast; -2.2% previous)

- European Union President von der Leyen announced a pause on reciprocal tariffs

- U.S. initial jobless claims for the week ending April 5: 223.0k (226.0k forecast; 219.0k previous)

- U.S. government clarified that the effective “floor” tariff rate on Chinese goods is 145% instead of 125%

- FOMC voting member Austan Goolsbee: Rate cuts still possible if economy gets back on track

- FOMC alternate member Lorie Logan warned on Thursday that tariff-induced inflation must not become permanent

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The major assets were all over the charts after Trump walked back part of his tariff bombshell. The U.S. initially slapped “reciprocal tariffs” on a broad range of imports, but Trump later announced a 90-day pause for most countries while maintaining a baseline 10% rate. China was the major exception, facing a massive tariff hike to 145%, which set off serious market whiplash.

European stocks ripped higher on the tariff pause, with the DAX up 4.5%, the CAC 40 gaining 3.8%, and the FTSE 100 adding 3.0%. U.S. equities rallied hard too, up nearly 10% on Wednesday, only to give back 3.5% on Thursday as doubts crept in about whether the rally had legs.

Treasury yields spiked, with the 10-year yield nearing 4.5%, fueling chatter that bond market pressure helped nudge Trump toward easing up. A solid 30-year auction brought some calm, even as some analysts started throwing around the phrase “bond vigilantes” again.

Gold stole the show, notching its biggest single day gain since April 2020 and smashing through record highs above $3,170 as investors ran for cover. WTI oil, meanwhile, dropped more than 3% to around $60 on renewed worries about global demand.

Even bitcoin was not spared, slipping from $83,000 to $79,000 as crypto traders braced for more macro-driven turbulence.

FX Market Behavior: U.S. Dollar vs. Majors:

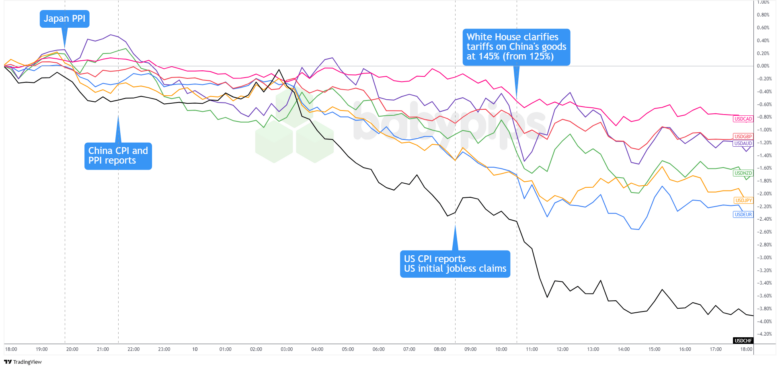

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar suffered its worst drop since November 2022, with its bearish momentum building up as markets digested a mix of soft data and rising global unease.

The slide began after Japan’s hotter-than-expected PPI gave the dollar a brief lift, but sentiment quickly turned after China’s CPI showed deflation for a second straight month. The soft print added to concerns about global demand, dragging the dollar lower in Asia.

Losses deepened in Europe as traders sold off the Greenback ahead of key US data. EUR/USD climbed past 1.1000, while USD/CHF tumbled below 0.8250 – its lowest since 2011 – as the dollar’s safe haven appeal came under fire amid rising trade tensions.

The real blow came when U.S. CPI data missed across the board. Headline inflation unexpectedly fell 0.1%, while core CPI barely budged. The dollar sold off sharply, especially against the Swiss franc, which gained nearly 4%.

The dollar kept its losses even with the 10-year bond yield nearing 4.5%, signaling deeper worries about U.S. fiscal stability and the risk of foreign outflows as trade tensions with China linger despite Trump’s softer tariff stance.

Upcoming Potential Catalysts on the Economic Calendar:

- Germany final CPI for March at 6:00 am GMT

- U.K. GDP for February at 6:00 am GMT

- U.K. goods trade balance for February at 6:00 am GMT

- U.K. balance of trade for February at 6:00 am GMT

- Swiss consumer confidence for March at 7:00 am GMT

- ECB President Lagarde to give a speech at 9:45 am GMT

- U.K. NIESR monthly GDP for March at 11:25 am GMT

- U.S. PPI for March at 12:30 pm GMT

- FOMC member Musalem to give a speech at 2:00 pm GMT

- University of Michigan U.S. consumer sentiment and inflation expectations for April at 2:00 pm GMT

- FOMC member Williams to give a speech at 3:00 pm GMT

Friday traders face another busy day, with U.K. GDP and trade data likely to drive pound moves, while ECB President Lagarde’s remarks could sway the euro during early European hours.

In the U.S., PPI and FOMC speeches may guide policy expectations, while non-data headlines could yield plot twists for bond markets and broader risk appetite.

As always, stay nimble and don’t forget to check out our brand new Forex Correlation Calculator when taking any trades!