This week, our currency strategists focused on the RBNZ Monetary Policy Statement for potential high-quality setups in the New Zealand dollar.

Out of the four scenario/price outlook discussions this week, one discussion arguably saw both fundie & technical arguments triggered to become potential candidates for a trade & risk management overlay.

Watchlists are price outlook & strategy discussions supported by both fundamental & technical analysis, a crucial step towards creating a high quality discretionary trade idea before working on a risk & trade management plan.

If you’d like to follow our “Watchlist” picks right when they are published throughout the week, you can subscribe to BabyPips Premium.

NZD/JPY: Tuesday – April 8, 2025

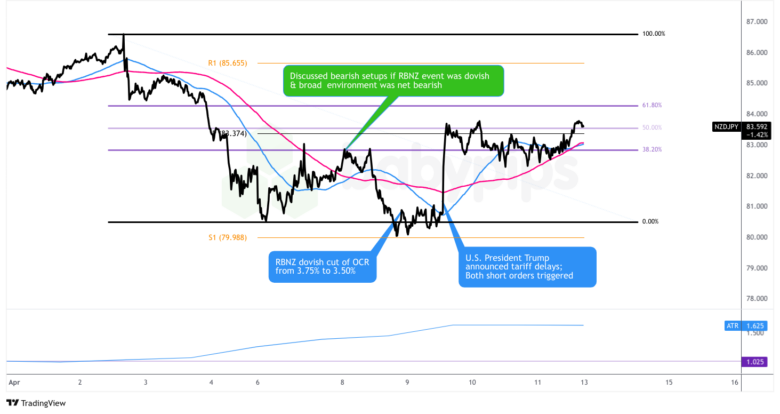

NZD/JPY: 1-Hour Forex Chart by TradingView

On Tuesday, our strategists had their sights set on the RBNZ monetary policy statement and its potential impact on the New Zealand dollar.

Based on our Event Guide, expectations were for the RBNZ to cut its Official Cash Rate by 25 basis points to 3.50%, marking its fourth consecutive rate reduction. Markets were particularly interested in whether the central bank would signal further rate cuts beyond the planned 50bps easing cycle outlined in February. With those expectations in mind, here’s what we were thinking:

The “Kiwi Climb” Scenario:

If the RBNZ delivered its expected 25bps cut but maintained a measured approach to future easing, we anticipated this could support NZD. We focused on NZD/USD for potential long strategies if risk sentiment was positive, especially given the Fed’s increasingly dovish comments amid U.S. growth concerns. This was particularly relevant with U.S.-China trade tensions showing early signs of stabilization following reports of the White House negotiating tariff deals.

If risk sentiment leaned negative, AUD/NZD short made sense given Australia’s vulnerability to China trade disruptions and Treasurer Chalmers’ comments about a potential 50bps RBA cut in May.

The “Kiwi Collapse” Scenario:

If the RBNZ signaled a more aggressive easing path due to global trade tensions, we thought this could weigh on NZD. We considered GBP/NZD for potential long strategies in a risk-on environment, given the U.K.’s relative resilience against trade tariffs and its steady uptrend against NZD since mid-March.

In a risk-off environment, NZD/JPY short looked promising given Japan’s safe-haven status during trade uncertainties and BOJ Governor Ueda’s recent comments about potential rate hikes, though he did signal a possible pause due to the U.S. tariff situation.

What Actually Happened:

The RBNZ cut its Official Cash Rate by 25 basis points to 3.50% as expected on April 9, marking its fifth consecutive rate reduction since beginning the easing cycle in August 2024. The outcome was notably more dovish than anticipated, with the Monetary Policy Committee, now chaired by interim Governor Christian Hawkesby following Adrian Orr’s surprise resignation in March, expressing significant concerns about global trade tensions.

Key points from the policy statement:

- Inflation remains near the midpoint of the 1-3% target band at 2.2%

- The economy is slowly recovering from recession with significant spare capacity

- Global trade tensions are creating downside risks, particularly Trump’s tariffs

- New Zealand’s vulnerability to global economic developments as an export-driven economy

The RBNZ left the door wide open for further monetary easing, explicitly stating: “As the extent and effect of tariff policies become clearer, the Committee has scope to lower the OCR further as appropriate.“

This dovish stance represented a shift from February’s more measured outlook, with markets quickly pricing in a 90% chance of another quarter-point cut in May, and expectations for rates to potentially reach 3.00% or lower by year-end.

Market Reaction:

This outcome fundamentally triggered our NZD bearish scenarios, and with risk sentiment leaning negative amid escalating U.S.-China trade tensions at the time of release, NZD/JPY became our focus.

Looking at the NZD/JPY chart, we can see the pair had been in a sharp downtrend since April 2nd, pressured by rising global trade concerns ahead of Trump’s “Liberation Day” tariffs. RBNZ’s dovish cut accelerated this downward momentum, with the pair retesting the S1 pivot support level (79.99) in the hours following the announcement.

The selloff intensified as markets digested the RBNZ’s explicit openness to further cuts beyond the previously planned easing cycle. However, NZD/JPY found solid support just above the 80.30 level, demonstrating remarkable resilience despite the dovish policy statement.

A significant reversal occurred later that day when U.S. President Trump announced a 90-day pause on higher reciprocal tariffs for most trade partners (excluding China). This unexpected development triggered a sharp risk-on move across markets, sending NZD/JPY back above the 83.50 handle and toward the 50% Fib retracement level.

For the rest of the week, NZD/JPY had stabilized between 83.00-84.00, buoyed by positive New Zealand manufacturing data, China’s non-escalation stance on trade tensions, and expectations of Chinese stimulus measures. The pair encountered resistance near the 83.00 psychological handle, but maintained most of its recovery gains.

The Verdict:

So, how’d we do? Our fundamental analysis correctly anticipated NZD weakness on a dovish RBNZ stance, which materialized briefly with the central bank’s focus on global trade risks and openness to further easing.

Our technical analysis also accurately identified the S1 pivot support level (79.99) as a key area to watch, which indeed provided the floor for the post-RBNZ selloff. However, the anticipated sustained weakness didn’t materialize as global risk sentiment took center stage.

We think this discussion was “neutral to not-likely” supportive of a net positive outcome. While the immediate reaction aligned with our expectations, several key factors worked against our bearish scenario: NZD/JPY didn’t break below the S1 Pivot Point after the event; price action reversed and closed well above post-RBNZ event levels; and Kiwi’s overall strength by week’s end suggests market participants placed greater emphasis on global risk sentiment and trade developments than on domestic monetary policy considerations.

Traders who shorted NZD/JPY would have briefly seen profits before facing a strong reversal. Quick profit-taking, tight stop-losses, and proper trade management would have been crucial to avoid losses, particularly given the whipsawing price action following Trump’s tariff pause announcement.

For those who followed our risk-off NZD/JPY bearish scenario, taking profits near the S1 level would have been prudent, yielding approximately 150-200 pips from entry levels around 81.50-82.00. Alternatively, trailing stops could have protected gains while allowing for potential further downside.

The week’s events reaffirmed a crucial lesson in forex trading: central bank policy divergence matters, but in times of heightened global uncertainty, broader risk sentiment can quickly overshadow monetary policy as the primary driver of currency movements.

The rapid reversal in NZD/JPY following the tariff announcement highlights the importance of staying nimble and maintaining awareness of the broader geopolitical landscape when trading event reactions.