U.S. flash PMI data for April showed mixed results, as the manufacturing industry stayed in expansion while services reported weaker growth. Output growth slowed to a 16-month low while prices saw their sharpest gains in over a year as tariffs concerns came in play.

The slowdown in business activity was most pronounced in the services sector, where growth decelerated to its second-weakest rate in the past year. Survey respondents frequently cited uncertainty surrounding the economy and tariffs as reasons for the slower expansion. Export sales of services fell at the fastest pace since January 2023.

Meanwhile, manufacturing output barely expanded, with the index registering just above the 50-point threshold that separates growth from contraction. While new orders placed at factories rose slightly, export orders fell markedly, with companies specifically linking trade policy to declining foreign sales.

Key Takeaways:

- The S&P Global Flash U.S. PMI Composite Output Index fell to 51.2 in April from 53.5 in March

- Manufacturing industry retained marginal growth (50.7) in April vs. 49.0 forecast while previous reading was upgraded to 50.2

- Services activity growth slowed sharply to 51.4 from 54.4 in March vs. 52.8 forecast

- Business confidence slumped to one of the lowest levels since the pandemic

- Selling prices rose at the sharpest rate in over a year, with manufactured goods seeing a steep increase linked to tariffs

Business expectations for the year ahead fell for the third consecutive month, dropping to the second-lowest level since September 2020, surpassed only by October 2022. The deterioration in sentiment was attributed to concerns over government policies and resulting economic uncertainty.

Employment growth also slowed in April, with manufacturing jobs decreasing for the first time since October. Companies cited concerns over the economic outlook, both domestically and in export markets, as well as rising costs as factors limiting hiring.

Particularly concerning for Federal Reserve policymakers, the report showed a significant acceleration in price pressures. Input costs in the manufacturing sector rose at the fastest pace since August 2022, as suppliers raised prices in response to tariffs, supply concerns, and currency depreciation.

Link to official S&P Global Flash U.S. PMI

Market Reactions

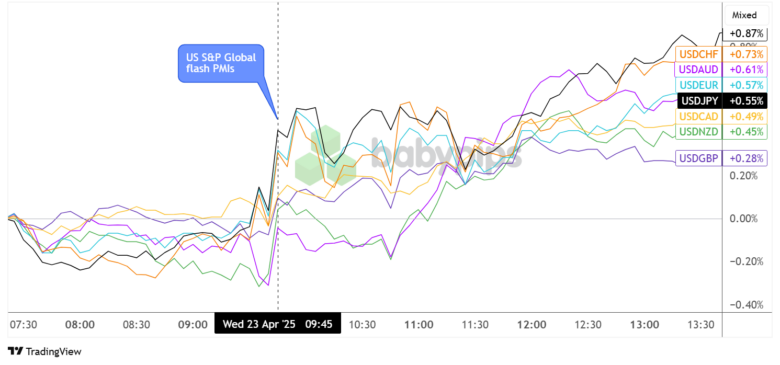

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar strengthened broadly against major currencies following the release, with the USD index rising approximately 0.87% by midday trading.

The dollar gained most significantly against the Swiss franc (+0.73%) and Japanese yen (+0.87%), while posting more modest gains against the British pound (+0.28%) a few hours after the report was printed.

Although USD pulled back from its initial bullish reaction versus AUD and NZD, it caught up to the rest of the rallies later in the day, with AUD/USD down 0.61% and NZD/USD lower by 0.45%.