This week, our currency strategists focused on the Euro Area Flash PMIs for April and their potential impact on the euro.

Out of the four scenario/price outlook discussions this week, one discussion arguably saw both fundie & technical arguments triggered to become potential candidates for a trade & risk management overlay.

Watchlists are price outlook & strategy discussions supported by both fundamental & technical analysis, a crucial step towards creating a high quality discretionary trade idea before working on a risk & trade management plan.

If you’d like to follow our “Watchlist” picks right when they are published throughout the week, you can subscribe to BabyPips Premium.

EUR/GBP: Tuesday – April 22, 2025

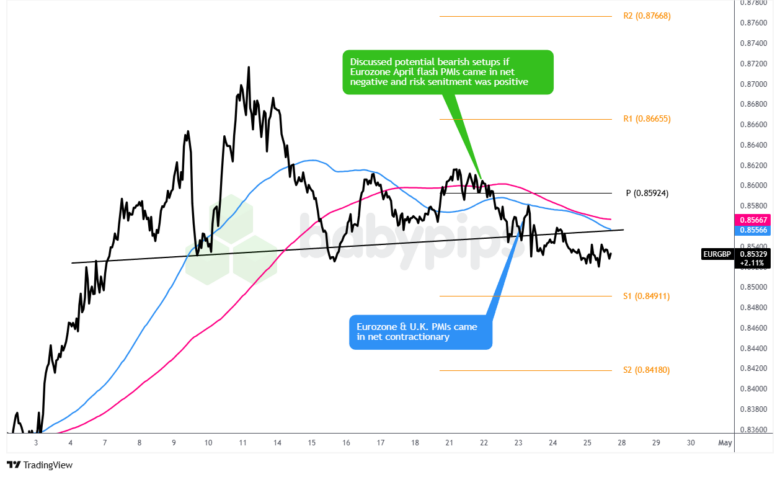

EUR/GBP: 1-Hour Forex Chart by TradingView

On Tuesday, our strategists had their sights set on the Euro Area flash PMI reports and their potential impact on the euro.

Based on our Event Guide, expectations were for manufacturing PMI to decline to 47.4 from 48.6, and services PMI to fall to 50.4 from 51.0. German and French PMIs were also expected to show deterioration, with manufacturing remaining in contractionary territory and services hovering around the expansion/contraction border.

With those expectations in mind, here’s what we were thinking:

The “Euro Euphoria” Scenario:

If the flash PMIs came in stronger than expected, particularly showing resilience in the services sector, we anticipated this could dampen expectations for aggressive ECB easing.

We focused on EUR/CHF for potential long strategies in a risk-on environment, especially as USD/CHF – a major franc pair – is already hanging out near levels where Swiss policymakers may consider currency intervention. With EUR/CHF forming an ascending triangle pattern with resistance around 0.9340, a break above could signal upward momentum.

If risk sentiment leaned positive, EUR/CAD long made sense given Canada’s higher exposure to U.S.-China trade friction, crude oil volatility, and the pair’s consolidation near the key 1.6000 level.

The “Euro Erosion” Scenario:

If the Eurozone flash PMIs disappointed, showing significant weakness in both manufacturing and services, we thought this could fuel ECB rate cut expectations.

We considered EUR/GBP for potential short strategies in a risk-off environment, particularly given the pair’s completion of a complex Head and Shoulders pattern as it hovered above the neckline around .8550 and the dynamic support at the 100 SMA. The pound also looked like a safer pick than the euro, since the U.K. was less directly exposed to the U.S. tariff drama.

If risk sentiment turned negative, EUR/JPY short looked promising given the safe-haven properties of the yen amid worsening U.S.-China trade tensions and the pair’s triangle formation with support around the 162.00 major psychological level.

What Actually Happened:

The April flash PMI readings showed mixed but generally disappointing results:

- Euro Area HCOB Manufacturing PMI Flash: 48.7 (vs. 47.5 forecast; 48.6 previous)

- Euro Area HCOB Services PMI Flash: 49.7 (vs. 50.7 forecast; 51.0 previous)

- Germany S&P Global Manufacturing PMI Flash: 48.0 (vs. 48.1 forecast; 48.3 previous)

- Germany S&P Global Services PMI Flash: 48.8 (vs. 50.7 forecast; 50.9 previous)

- France S&P Global Manufacturing PMI Flash: 48.2 (vs. 47.9 forecast; 48.5 previous)

While the manufacturing sector showed some resilience, the services sector was the major disappointment, falling into contractionary territory (below 50.0) for the first time since December 2024. The composite PMI, which combines both sectors, dropped to 49.9 from 50.3, suggesting that the Eurozone economy is stagnating.

The reports highlighted concerns about global trade tensions and their impact on business sentiment. Services providers reported weakening domestic demand, while manufacturers continued to struggle with higher input costs and supply chain disruptions related to increased tariffs.

This outcome fundamentally triggered our “Euro Erosion” scenario, as the unexpectedly weak services PMI raised concerns about the broader Eurozone economic outlook and reinforced expectations for further ECB rate cuts.

Market Reaction:

The initial market response to the Eurozone PMI data was decisively bearish for the euro across the board, aligning with our “Euro Erosion” scenario. Looking at our EUR/GBP chart, we can see that the pair was already testing the neckline of the Head and Shoulders pattern around 0.8550 before the data release.

When the disappointing PMIs hit the wires, EUR/GBP broke below the neckline with conviction, confirming the bearish pattern. The pair accelerated its decline as it bounced from the 100 SMA, then headed for the S1 Pivot Point (0.8500) during the European session.

Sterling’s relative strength was evident despite its own disappointing PMI figures (manufacturing at 44.0 and services at 48.9), which suggests that the market had already priced in the UK’s economic weakness. In contrast, the unexpectedly poor Eurozone services PMI caught traders off guard, triggering a more pronounced reaction.

ECB President Lagarde’s comments the following day about the disinflation process “nearing completion” and policy becoming “data dependent to the extreme” further pressured the euro, suggesting a potentially more dovish stance amid economic uncertainty. Meanwhile, BOE Governor Bailey’s remarks about taking “seriously” the global effects of Trump’s policies, while signaling future rate cuts, had limited impact on the pound.

The pair found some stability near the 0.8525, with a slight rebound during Thursday’s session as German Ifo business climate (86.9 vs 85.1 expected) and French confidence figures surprised to the upside. However, the downward pressure resumed on Friday as traders continued to digest the implications of contractionary Eurozone services PMI against the backdrop of global trade tensions.

The Verdict:

So, how’d we do? Our fundamental analysis correctly anticipated euro weakness on disappointing PMI data, which materialized particularly in the services sector. Our technical analysis accurately identified the Head and Shoulders pattern and potential breakdown levels, which played out precisely as the pattern suggested.

We think this discussion was “highly likely” supportive of a net positive outcome as both fundamental and technical triggers aligned well. The weaker-than-expected Eurozone services PMI did provide the catalyst for the head and shoulders breakdown, though the pair only fell to around 0.8525, not quite reaching the S1 pivot point at 0.8500.

If traders entered short positions on the neckline break around 0.8550, they could have captured a modest 25-pip move, representing about half of the daily ATR. While this would still have been profitable, the limited follow-through suggests some underlying support for the euro despite the disappointing data.

Risk management would have been relatively straightforward with a stop above the right shoulder of the pattern, still offering a reasonable risk-to-reward ratio for a short-term trade.

The key lesson here is the importance of focusing on the services sector in developed economies like the Eurozone. While manufacturing has been struggling globally due to trade tensions, services had remained relatively resilient until this report. The unexpected contraction in Eurozone services signaled broader economic concerns, triggering a more significant market reaction than the manufacturing figures alone would have.

Overall, this trade setup demonstrates how combining technical pattern recognition with fundamental catalyst alignment can create high-probability trading opportunities, even in a complex global trading environment dominated by geopolitical uncertainties and shifting central bank expectations.