The ISM Manufacturing PMI for April 2025 registered at 48.7, down 0.3 percentage points from March’s 49.0 reading.

While this marks the second consecutive month of contraction in the manufacturing sector, the figure came in better than economists’ expectations of 47.9, suggesting the pace of decline is more moderate than anticipated.

Key components of the April report:

- New Orders Index: 47.2 (up 2.0 points but still contracting)

- Production Index: 44.0 (down 4.3 points, showing accelerated contraction)

- Employment Index: 46.5 (up 1.8 points but remaining in contraction)

- Prices Index: 69.8 (up 0.4 points, indicating continued price pressures)

- Supplier Deliveries Index: 55.2 (up 1.7 points, showing slower deliveries)

Link to official U.S. ISM Manufacturing PMI (April 2025)

The report revealed persistent concerns about tariffs, with numerous survey respondents highlighting disruptions from President Trump’s trade policies. While 11 of 18 industries continue to grow, U.S. exports are taking a serious hit, as shown by the sharp 6.5-point drop in the Export Orders Index to 43.1.

Meanwhile, companies are rushing to stock up on materials before tariffs fully kick in, even as they face increasing delays in receiving supplies (Supplier Deliveries up 1.7 to 55.2) and rising costs for the 19 commodities reported higher in price, including aluminum, which has increased for 17 consecutive months.

According to ISM Chair Timothy Fiore, “Demand and production retreated and destaffing continued, as panelists’ companies responded to an unknown economic environment.”

Market Reaction

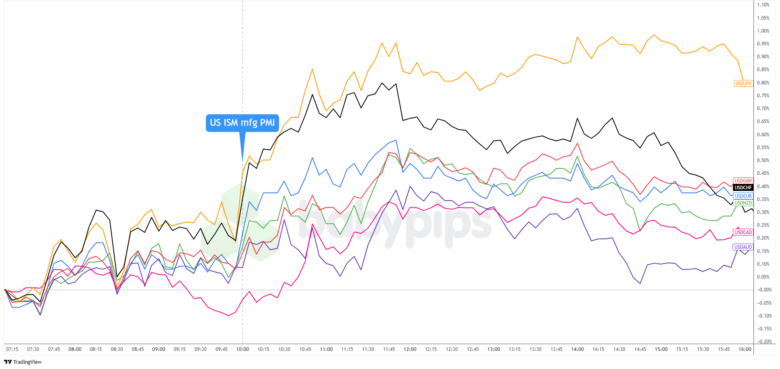

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar, which had just shrugged off a disappointing weekly initial jobless claims report, swung broadly higher at the ISM PMI release.

The market was particularly worried about the impact of Trump’s recent tariffs on manufacturing, but the report suggested that companies are coping slightly better than anticipated. While the industry remained in contraction, the reading came in better than expected and relieved fears of a more severe manufacturing turndown.

On top of that, with prices still rising rapidly (as shown by the high Prices Index), traders believe the Federal Reserve might be less likely to cut interest rates soon, which is supportive of Greenback demand.

The dollar’s upswing during the U.S. session enabled USD to cap the day in the green across the board, with the biggest gains seen against JPY, NZD, and CHF.