As expected, the Fed kept interest rates on hold at 4.25-4.50% for the third consecutive meeting during their May decision, citing trade uncertainty and stagflation risks as reasons to stay cautious.

In their official statement, the FOMC mentioned that while economic activity “has continued to expand at a solid pace,” uncertainty has significantly increased. Policymakers also pointed out that “the risks of higher unemployment and higher inflation have risen.”

Key Takeaways:

- The FOMC unanimously voted to keep the federal funds rate target range at 4.25%-4.5%

- The Fed acknowledged “increased uncertainty” in its economic outlook

- Statement noted risks to both inflation and unemployment have risen

- Powell emphasized a “wait-and-see” approach to monetary policy during the press conference

- Reduction of balance sheet runoff for Treasury securities continues at $5 billion monthly cap

On a more optimistic noted, the Fed statement also stated that “Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace.”

As for hiring and price pressures, policymakers gauged that “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.” Without explicitly mentioning tariffs, the Fed’s statement clearly reflected concerns about the Trump administration’s trade policies.

Link to May 2025 FOMC Statement

During the press conference, Chairperson Jerome Powell addressed these worries more directly, noting that the magnitude, scope, and persistence of recently implemented tariffs remain uncertain. He emphasized that there was “little to no cost” to waiting for more economic clarity before adjusting policy rates.

Furthermore, Powell suggested that while tariffs could cause one-time price increases, they might not necessarily lead to persistent inflation pressures.

Market Reaction

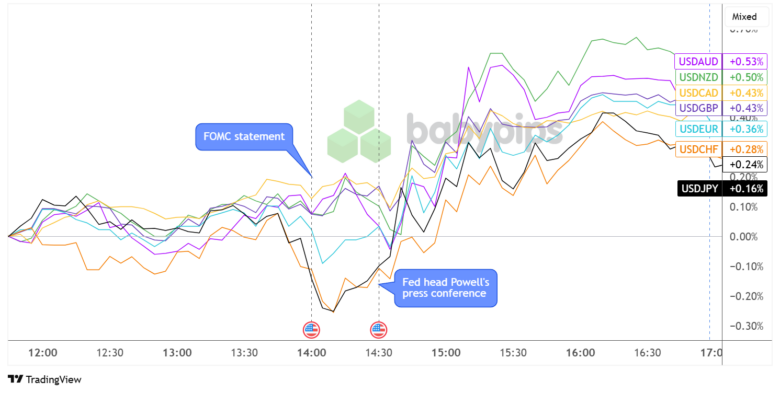

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar, which had been trading cautiously ahead of the actual Fed statement, dipped lower against its safe-haven rivals (CHF and JPY) as well as the euro immediately after the announcement.

However, Powell’s press conference triggered a broad bullish reaction from the currency likely as traders took comfort in the Fed head’s assessment that the “economy itself is still in solid shape.” The CME FedWatch Tool now predicts close to an 80% chance of rates staying unchanged in the next FOMC meeting compared to 68.8% a day ago.

The dollar sustained its climb in the hours that followed, raking in its strongest gains versus the commodity currencies while USD/CHF (+0.28%) and USD/JPY (+0.24%) lagged behind.