Data from the Australian Bureau of Statistics showed Australia’s labor market adding 89,000 jobs in April, far outpacing forecasts of a 20,000-22,500 increase.

At the same time, the unemployment rate held steady at 4.1% as more people entered the workforce, with the participation rate climbing to 67.1%.

Full-time employment led the way with 59,500 new positions, while part-time roles grew by 29,500.

Despite these impressive figures, monthly hours worked remained essentially unchanged, suggesting some underlying softness in labor demand.

Link to ABS April 2025 Employment Report

Here are key points from April’s employment report:

- Total employment increased by 89,000, well above expectations

- The unemployment rate remained at 4.1%

- Full-time employment increased by 59,500 positions

- Part-time employment grew by 29,500 jobs

- Participation rate rose to 67.1% from 66.8% in March

- Monthly hours worked remained essentially unchanged

Analysts suggest the surge in employment may be partly related to the Federal election campaign, meaning this strength could be short-lived.

Despite the robust job figures, many analysts remain confident the Reserve Bank of Australia (RBA) will proceed with rate cuts.

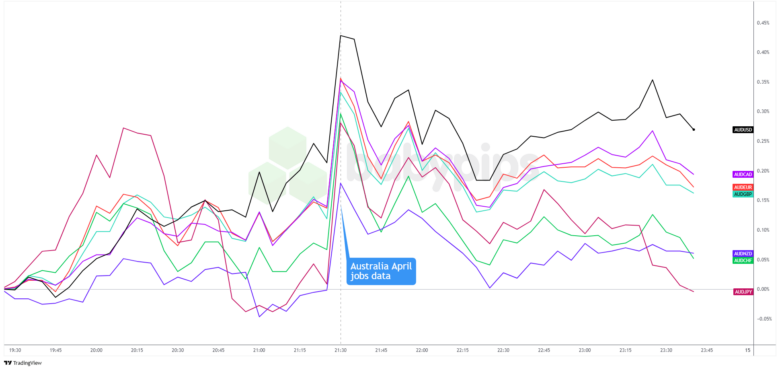

Overlay of AUD Pairs vs. Major Currencies Chart by TradingView

The Australian dollar, which saw increased volatility around the Japanese market open, jumped broadly at Australia’s jobs release.

But the comdoll quickly pulled back most of its gains, possibly as traders lock in on a possible RBA interest rate cut next week.

AUD’s price action suggests that traders are unconvinced that the strong employment figures will derail the central bank’s easing plans. Analysts point to flat hours worked and steady unemployment as indications that sufficient labor market slack remains to justify a rate reduction.

Despite the pullbacks, AUD remains in the green against the U.S. dollar and “risk” currencies like GBP, NZD, and CAD while staying in the red against CHF, JPY, and EUR.