The Reserve Bank of Australia lowered its cash rate by 25 basis points to 3.85% at Tuesday’s policy meeting, marking its second rate cut this year after February’s initial easing.

But while the rate reduction itself was widely anticipated (markets priced in a 96% probability ahead of the decision), the accompanying statement and economic projections struck a notably more dovish tone than expected, triggering a sharp selloff in the Australian dollar.

Key Takeaways:

- RBA cut its cash rate by 25 bps to 3.85% as expected

- GDP growth forecast was lowered to 2.1% for 2025 (from 2.4%) with unemployment expected to rise to 4.3%

- Underlying inflation projections were revised down to 2.6% (from 2.7%), closer to the midpoint of the target range

- The RBA outlined a “severe downside scenario” where trade war escalation could push unemployment to nearly 6%

- Global economic uncertainty, particularly US trade policy, was emphasized as a key risk to the outlook

- Governor Bullock’s cautious comments during the press conference helped stabilize AUD crosses

- AUD crashed immediately after the RBA’s dovish rate cut, with losses of 0.4%-0.7% against major currencies

- Markets now expect approximately 85bps of additional cuts by mid-2026

In its May Monetary Policy Statement, RBA significantly revised its economic projections, with GDP growth forecast at just 2.1% over 2025 (down from 2.4% in February) and 2.2% in 2026.

The unemployment rate is now expected to rise to 4.3% (up from 4.2%) and stabilize at that level, representing a slightly weaker labor market outlook.

On inflation, the RBA now projects underlying inflation to settle around 2.6% (down from 2.7%), near the midpoint of the 2-3% target range throughout the forecast period, while headline inflation was projected to reach 3.0% by mid-2025 before moderating.

The central bank also presented alternative scenarios including a “trade war” scenario where unemployment could rise to nearly 6% and a “trade peace” scenario that would lead to stronger growth and possibly higher inflation, reflecting the high degree of uncertainty in the current environment.

Link to official RBA Monetary Policy Statement for May 2025

In her presser, RBA Governor Bullock emphasized that the Board considered a “severe downside scenario” involving trade war escalation that could push unemployment to nearly 6% and inflation down to 2%, highlighting the RBA’s readiness to respond to international developments if needed.

While acknowledging downside risks from global trade tensions, she also emphasized the RBA’s readiness to respond decisively if needed rather than pre-committing to a specific easing path.

Link to RBA Press Conference for May 2025

Market Reaction:

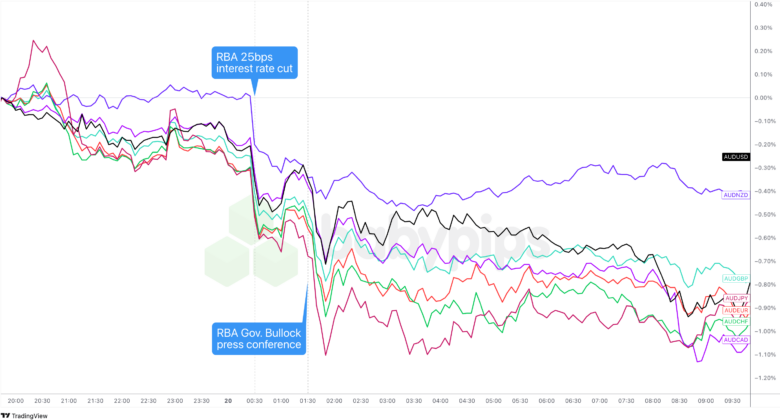

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart by TradingView

The Australian dollar, which was already trading with a bearish lean despite the People’s Bank of China (PBOC) announcing measured interest rate cuts, dropped sharply and broadly at the RBA’s dovish cut.

The commodity-related currency pulled back some of its initial move, but also extended its losses after RBA Gov. Bullock shared that they debated cutting rates by 50bps and that they considered a “severe downside scenario” involving a trade war escalation.

Still, Bullock’s more balanced tone, and her emphasis that the decision to cut was “difficult” helped limit AUD’s further downside momentum in the early European trading.

Despite this partial recovery, most AUD crosses remained significantly lower than pre-announcement levels. AUD closed broadly lower, with the biggest losses recorded against CHF, JPY, and EUR.

Market pricing now suggests further easing in the months ahead, with approximately 85 basis points of additional cuts priced in by mid-2026. Yipes!