The major assets were all over the charts on Tuesday, driven by renewed concerns over U.S. fiscal sustainability and rising geopolitical tensions in the Middle East.

Traders juggled mixed signals from central banks, inflation data, and the lingering impact of Friday’s U.S. credit downgrade, triggering big moves in bonds, stocks, currencies, and commodities.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- China loan prime rate 5Y for May: 3.5% (3.5% forecast; 3.6% previous); 1Y rate slashed to 3.0% (3.0% forecast; 3.1% previous)

- AUD Slumps After RBA’s Dovish Rate Cut, Slightly Recovers on Bullock Comments

- Germany producer prices index growth rate for April: -0.9% y/y (-0.7% y/y forecast; -0.2% y/y previous); -0.6% m/m (-0.3% m/m forecast; -0.7% m/m previous)

- Euro area current account s.a for March: €50.9B (€30.6B forecast; €34.3B previous)

- U.K. BoE Chief Economist Huw Pill favors a more cautious pace for interest rate cuts

- Euro area labour cost index flash for Q1 2025: 3.2% y/y (3.7% y/y previous)

- Euro Area consumer confidence flash for May: -15.2 (-16.0 forecast; -16.7 previous)

- Canada’s Headline CPI Slowed to 1.7% in April, Core Inflation Higher

- Iran’s supreme leader Ayatollah Ali Khamenei said nuclear talks with the U.S. are unlikely to yield any results

- New Zealand Global Dairy Trade price index for May 20: -0.9% (4.6% previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Moody’s downgrade of US credit from Aaa to Aa1 on Friday continued to send markets into a tailspin, with Treasury yields spiking and the 30-year briefly breaching 5% before dip-buyers stepped in.

US equities pulled back, ending the S&P 500’s six-day winning streak. Meanwhile, European markets pushed higher on optimism around a UK-EU trade reset and signs of progress in Russia-Ukraine ceasefire talks following what was described as a “very well received” Trump-Putin call.

Oil prices soared into the close after CNN reported that Israel might be preparing strikes on Iranian nuclear sites, a serious geopolitical threat that could rattle Middle East oil flows. Gold surged to $3,290 as investors sought safer havens amid growing concerns about US debt sustainability. Bitcoin also showed resilience, trading around $106,500 after bouncing back from earlier weakness tied to sovereign risk jitters.

The 10-year Treasury yield settled at 4.48% after hitting 4.55%, reflecting market uncertainty around the long-term impact of Trump’s tax bill, especially as it moves forward without offsetting spending cuts.

JPMorgan CEO Jamie Dimon added fuel to the caution, warning that market valuations may be underestimating inflation risks and calling out what he sees as “an extraordinary amount of complacency” following stocks’ quick rebound from tariff headlines.

FX Market Behavior: U.S. Dollar vs. Majors:

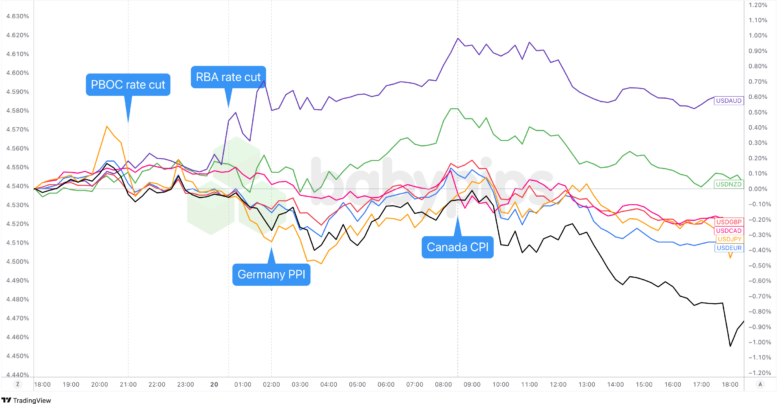

Overlay of USD vs. Major Currencies Chart by TradingView

The US dollar saw wild swings on Tuesday as traders juggled global data surprises, shifting rate expectations, and mixed Fed commentary. The day started on a weak note, with dollar selling picking up after Moody’s credit downgrade and a softer-than-expected German PPI print (-0.9% y/y vs -0.6% forecast). The euro and Swiss franc gained as markets leaned toward continued ECB easing.

During European trading, the dollar stabilized as traders squared positions ahead of key North American events. China’s rate cut failed to stir markets, while the RBA’s dovish tone pushed AUD lower after Governor Bullock revealed a 50bp cut was under discussion, giving the dollar a temporary lift.

The biggest USD reaction came after Canada’s hotter CPI data slashed BOC rate cut odds from 65% to 35%, sparking a sharp but short-lived dollar bounce. Fed speakers offered no clear direction. Musalem warned that tariffs could hurt the labor market, while Bostic stuck to a cautious stance, expecting only one cut in 2025.

The uncertainty over the US tax and deficit plans continued to weigh on USD for for the rest of the U.S. session, with the dollar closing lower across the board, particularly against the Swiss franc, euro, and the Japanese yen.

Upcoming Potential Catalysts on the Economic Calendar:

- New Zealand balance of trade for April at 10:45 pm GMT

- U.S. Fed Daly speech at 11:00 pm GMT

- U.S. Fed Hammack speech at 11:00 pm GMT

- Japan balance of trade for April at 11:50 pm GMT

- Australia Westpac leading index for April at 1:00 am GMT

- New Zealand credit card spending y/y for April at 3:00 am GMT

- U.K. inflation rate updates for April at 6:00 am GMT

- Euro area ECB financial stability review at 8:00 am GMT

- U.S. MBA mortgage applications & 30-year mortgage rate for May 16 at 11:00 am GMT

- Canada new housing price index for April at 12:30 pm GMT

- U.S. EIA crude oil stocks change for May 16 at 2:30 pm GMT

- Euro area ECB Lane speech at 4:00 pm GMT

- U.S. Fed Barkin speech at 4:00 pm GMT

- Australia S&P Global manufacturing and services PMI flash for May at 11:00 pm GMT

- Japan Reuters Tankan index for May at 11:00 pm GMT

- Japan machinery orders for March at 11:50 pm GMT

The European session will be driven by the U.K.’s April inflation report and the ECB’s financial stability review, with ECB Lane’s speech offering a potential late-session catalyst for euro traders.

In the U.S. session, focus will be on crude oil volatility from the EIA stockpile data and any hawkish tilt in Fed Barkin’s speech, while housing data from both the U.S. and Canada offer second-tier cues.

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!