The major assets took a chill pill on Thursday as traders priced in a lack of top-tier data releases and the U.S. markets out on Thanksgiving holiday.

Some popular U.S. dollar counterparts got a few points in, while others took directional cues from individual headlines.

We’re detailing Thursday’s most notable market moves:

Headlines:

- ANZ: New Zealand business confidence eased from 65.7 to 64.9 in November; Employment intentions jumped from 14.2 to 14.7; Pricing intentions fell from 44.2 to 42.2

- Australia private capital expenditure for Q3 2024: 1.1% q/q (0.9% expected, -2.2% previous)

- Spain flash CPI for November: 2.4% y/y (2.3% expected, 1.8% previous)

- RBA Gov. Bullock thinks core inflation is “too high” to consider near-term interest rate cuts

- Germany preliminary CPI for November: -0.2% m/m (-0.2% expected, 0.4% previous)

- Canada current account deficit shrank from 4.7B CAD to 3.2B CAD in Q3 2024

- Tokyo core CPI accelerated from 1.8% y/y to 2.2% y/y (2.0% expected) in November

- Japan unemployment rate rose from 2.4% to 2.5% as expected in October

- Japan preliminary industrial production shot up from 1.6% m/m to 3.0% m/m (3.8% expected) in October

- Japan retail sales for October: 1.6% m/m (2.1% expected, 0.7% previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

With U.S. markets closed for the holiday and no major catalysts driving the action, markets took their cues from individual headlines.

Tensions flared as both Israel and Iran-backed Hezbollah accused each other of ceasefire violations just two days into their agreement. This, paired with some softness in the U.S. dollar, pushed gold higher during the late Asian and early European sessions.

Crude oil prices also saw a lift from these headlines, but gains were capped after OPEC+ postponed its meeting by a few days. Spot gold briefly tested the $2,650 level before easing back to around $2,635, while U.S. oil prices bounced between $68.25 and $69.25.

Meanwhile, bitcoin stayed mostly quiet under $96,000 after failing to hold above $97,000 earlier this week.

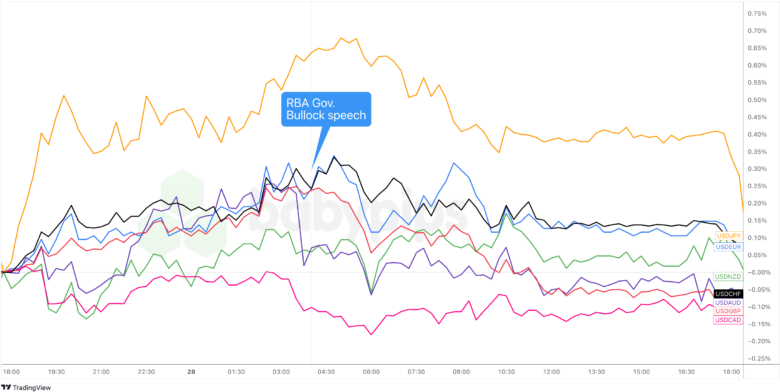

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar kicked off the day with modest gains, building on the late-session rebound from the previous day. USD/JPY, in particular, surged past the 150.00 mark and came close to 152.00, even without any fresh drivers.

The dollar lost some ground during the European session, likely as stronger-than-expected German inflation data and gains in regional tech stocks boosted risk sentiment. Meanwhile, the Aussie took a hit after the Reserve Bank of Australia shut down expectations for near-term rate cuts, pulling AUD/USD lower.

Later, volatility took a chill pill during the U.S. session while U.S. traders were on Thanksgiving holiday.

Upcoming Potential Catalysts on the Economic Calendar:

- Germany import prices at 7:00 am GMT

- Germany retail sales at 7:00 am GMT

- France consumer spending at 7:45 am GMT

- France preliminary CPI at 7:45 am GMT

- France preliminary GDP at 7:45 am GMT

- Switzerland GDP at 8:00 am GMT

- Switzerland KOF economic barometer at 8:00 am GMT

- Germany unemployment change at 8:55 am GMT

- U.K. mortgage approvals at 9:30 am GMT

- U.K. net individual lending at 9:30 am GMT

- Eurozone flash CPI reports at 10:00 am GMT

- Italy preliminary CPI at 10:00 am GMT

- U.K. BOE financial stability report at 10:30 am GMT

- U.K. FPC statement and meeting minutes at 10:30 am GMT

- U.K. BOE Gov Bailey to give a speech at 11:00 am GMT

- Germany Buba President Nagel to give a speech at 1:00 pm GMT

- Canada monthly GDP at 1:30 pm GMT

The European session kicks off with a jam-packed calendar, featuring key updates like Germany’s retail sales and France’s GDP, CPI, and consumer spending figures.

As the U.S. session gets underway, eyes will shift to Canada’s GDP release at 1:30 pm GMT, while central bank speakers from the U.K. and Germany could spark additional volatility.

Make sure you’re glued to the tube in case we see increased volatility during their events, and don’t forget to check out our Currency Correlation tool when taking any trades!