The European Central Bank (ECB) lowered its key interest rates by 0.25% as expected, bringing the deposit facility rate to 3.00%, while signaling a potentially more measured approach to future cuts.

This marks the ECB’s fourth consecutive rate reduction as inflation continues to moderate in the eurozone.

Key points from the ECB statement:

- Deposit rate cut by 25bps to 3.00%, with corresponding adjustments to other key rates

- Staff projections show headline inflation averaging 2.4% in 2024 and 2.1% in 2025

- Growth outlook downgraded, with GDP now expected at 0.7% in 2024 and 1.1% in 2025

- Inflation forecasts also lowered marginally from 2.5% to 2.4% in 2024 and 2.3% to 2.1% in 2025

- ECB dropped language about keeping rates “sufficiently restrictive”

- Some policymakers initially pushed for a larger 50bp cut but found little support

The removal of previously language on keeping policy rates “sufficiently restrictive for as long as needed” to achieve their inflation target suggests the central bank is transitioning away from its hawkish stance, although Lagarde emphasized during the press conference that future decisions will remain data-dependent and meeting-by-meeting.

Link to ECB Press Conference (December 2024)

In addition, Lagarde also highlighted better-than-expected growth in the third quarter and an economy that “should strengthen over time” while also citing that it’s still too early to react to any possible regulation changes coming from the Trump administration.

Market Reactions

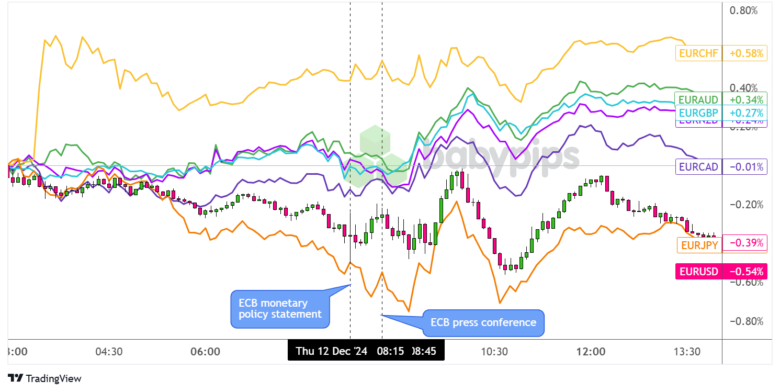

Overlay of EUR vs. Major Currencies Chart by TradingView

The euro saw mixed trading across the board following the ECB’s announcement and subsequent press conference. Initial moves were relatively contained as the 25bp cut was largely priced in by markets while most pairs appeared to sustain trends from earlier in the day.

In particular, EUR/JPY and EUR/USD carried on with its ongoing slide while EUR/CHF continued to move sideways, even during the ECB presser. However, the common currency found support against GBP, AUD, NZD, and CAD from ECB head Lagarde’s remarks citing that “a lot of ground has been covered” with the rate cuts to date.

Still, the euro failed to make much headway as the session went on, seeing another bearish wave across the board a couple of hours after the event. Towards the end of the European session, EUR/USD was down about 0.54%, while EUR/CHF showed relative strength, gaining 0.58%. EUR/JPY declined 0.39%, while other euro crosses like EUR/GBP and EUR/AUD showed modest gains.