The Federal Reserve pulled the trigger on another 25-basis-point rate cut at its December meeting, lowering the federal funds rate to a range of 4.25-4.50%. This marks their third straight cut this year. But this time, the tone was different — more cautious, hinting that the pace of future easing could slow down.

- Target federal funds rate cut to 4.25-4.50% range

- Overnight reverse repo rate adjusted to 4.25% (30bp cut)

- Cleveland Fed’s Hammack dissented, preferring no change (Hammack will not be voting next year)

In their statement, Fed officials acknowledged the economy continues to expand at a solid pace, while labor market conditions have generally eased but remain tight.

The Committee also noted that while inflation has made progress toward its 2% objective, it remains somewhat elevated and may require a more patient approach to further easing.

Link to official FOMC Statement (December 2024)

The Fed made substantial revisions to its economic outlook:

- GDP Growth: Raised 2024 forecast to 2.5% (from 2.0%), 2025 at 2.1%

- Unemployment Rate: Lowered 2024 projection to 4.2% (from 4.4%)

- PCE Inflation: Increased 2024 forecast to 2.4% (from 2.3%)

- Core PCE: Raised to 2.8% for 2024 and 2.5% for 2025

- Fed Funds Rate: Year-end 2025 median now at 3.9% (implying only two cuts)

The most significant shift came in these projections, with officials now forecasting just two rate cuts in 2025 instead of the four cuts signaled in September. They also raised their inflation outlook, pushing back the timeline for reaching their 2% target to 2026.

Link to official FOMC Revised Projections (December 2024)

During the press conference, Fed Chair Powell emphasized the transition to a new phase, stating, “With today’s action, we have lowered our policy rate by a full percentage point from its peak, and our policy stance is now significantly less restrictive.” He stressed that this position allows them to be more cautious with future adjustments.

When questioned about incorporating potential policy changes from the incoming administration, Powell maintained that while some committee members had begun considering possible effects, the Fed would only respond to actual implemented policies rather than speculation.

Link to FOMC Press Conference (November 2024)

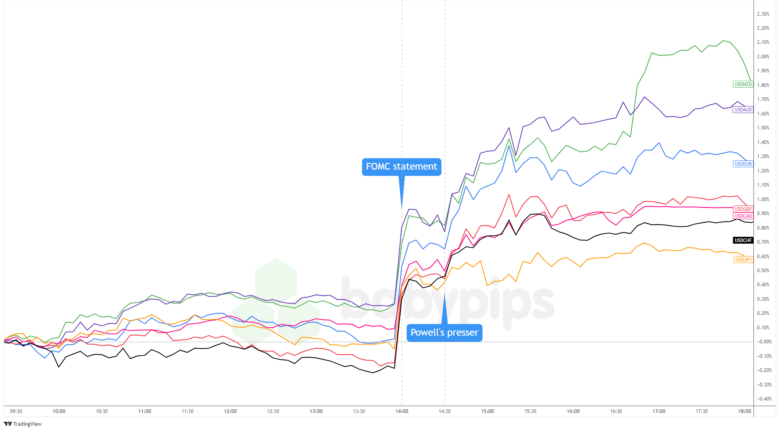

Market Reactions

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar surged across the board as markets digested the Fed’s more hawkish outlook. The dollar index reached a two-year high above 108.00, while EUR/USD dropped sharply to 1.037. Other major currencies saw similar moves, reflecting the significant repricing of 2025 rate cut expectations.

The “hawkish cut” triggered broader market reactions, with U.S. stocks posting their largest daily declines in months. The Dow Jones notably marked its tenth consecutive day of losses, while Treasury yields climbed substantially, with the 10-year rate reaching 4.508%.

This decision marks a clear pivot in the Fed’s approach, suggesting a more deliberate and cautious path toward monetary policy normalization as they balance economic growth against persistent inflation pressures.