Data from the U.S. Bureau of Labor Statistics was a mixed bag, with headline inflation rising more than expected but core inflation showing signs of moderation.

Headline CPI climbed 0.4% in December, beating the forecast of 0.3%, mainly due to a 2.6% jump in energy prices.

Monthly core CPI—which leaves out food and energy—came in at 0.2%, lower than the expected 0.3%. That’s a step down from the steady 0.3% increases we’ve seen recently!

On an annual basis, headline CPI sped up to 2.9% from November’s 2.7%, but core inflation dipped to 3.2% from 3.3%. This hints that underlying price pressures may be cooling more quickly than anticipated.

Link to the official U.S. CPI Report (December 2024)

Details also revealed that:

- Energy costs jumped 2.6%, the largest increase in nine months

- Food prices showed moderate gains

- Shelter costs continued their gradual deceleration

- Service sector inflation excluding housing showed signs of easing

The CME FedWatch tool briefly showed traders pricing in about two rate cuts by year-end, compared to expectations for just one cut before the CPI release. The first cut is still anticipated in June, but the odds for a second cut have increased significantly.

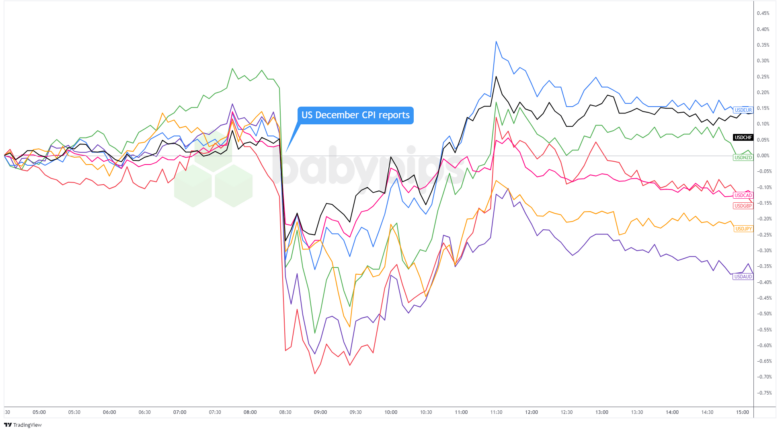

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar, which had been trading cautiously above its intraday lows ahead of the CPI release, fell sharply across the board as traders grew more confident on further Fed rate cuts.

Although headline inflation came in hotter than expected, the Greenback weakened broadly as traders focused on the softer core reading.

USD fell particularly sharply against “risk” currencies like the British pound and the Australian dollar and showed weakness against most other major currencies.

But the selloff didn’t last long. Within an hour, the dollar found its footing and started climbing again.

The rebound was likely driven by several factors: persistent inflation in services and other key components, waning expectations for Fed rate cuts, and what might have been a classic “sell the rumor, buy the news” scenario.

By the end of the European session, the Greenback had regained its footing, hovering near pre-CPI levels.