New Zealand’s quarterly employment report showed a 0.1% uptick in hiring as expected in Q1 while the unemployment rate held steady at 5.1% instead of rising to 5.3%.

Meanwhile, the labor force participation rate slowed from 71% to 70.8% while the labor cost index fell short of estimates at a 0.4% quarter-on-quarter increase instead of the estimated dip from 0.6% to 0.5%.

Key components of the Q1 2025 report:

- Employment change: +0.1% q/q as expected, previous reading downgraded from -0.1% to -0.2%

- Unemployment rate steady at 5.1% vs. expectations of increase from 5.1% to 5.3%

- Labor force participation rate down from 71% to 70.8% instead of holding steady

- Labor cost index: +0.4% q/q vs. 0.5% consensus, 0.6% previous

- Underutilization rate at 12.3% vs. 12.1% estimate

Link to New Zealand Labour Market Statistics (March 2025 Quarter)

On a year-on-year basis, wage growth still saw a decent 2.9% gain, reflecting sticky price pressures that could keep overall consumer inflation elevated. The dip in participation rate, however, suggested that folks in New Zealand may be feeling less optimistic about labor market conditions.

In addition, the downgrade to the previous quarter’s employment change figure indicated that the jobs picture was not as rosy as initially reported. Compared to the March 2024 quarter, 45K fewer people were employed full-time while part-time hiring rose 25K.

Market Reaction

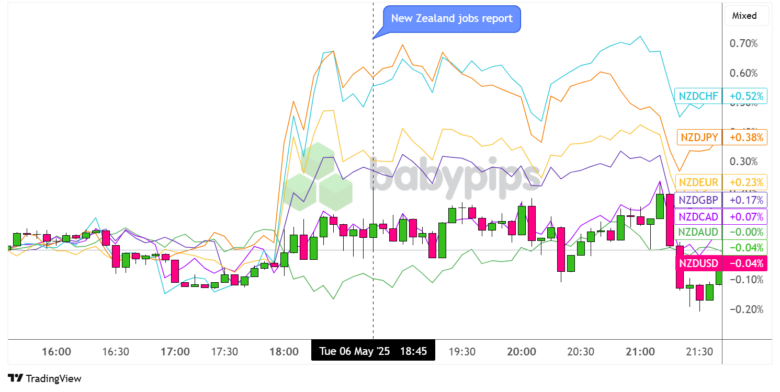

New Zealand Dollar vs. Major Currencies: 5-min

Overlay of NZD vs. Major Currencies Chart by TradingView

The Kiwi, which had been consolidating a couple hours leading up to the jobs release, already popped higher against CHF, JPY, EUR and GBP a few minutes before the numbers were printed. This relative weakness was likely spurred by weak eurozone PPI and some safe-haven selling on account of U.S.-China trade developments earlier on.

Apart from that, the New Zealand dollar didn’t seem to have much of a reaction to the mixed jobs data, as positive headline readings didn’t exactly mask underlying weaknesses. NZD pairs continued to move mostly sideways hours after the report was released, before drawing additional support after a pullback thanks to somewhat optimistic trade remarks from RBNZ head Hawkesby.

NZD/CHF was able to hold on to a 0.52% gain, followed by NZD/JPY with a 0.38% lead, while the Kiwi barely budged against its fellow comdolls AUD and CAD.