Canada reported a dip in its headline annual CPI from 2.3% to 1.7% in April, but other measures of inflation beat market estimates.

Components revealed that the removal of the federal carbon price pushed energy costs sharply lower, leaving core inflation metrics to reach 13-month highs, potentially complicating the Bank of Canada’s path to further rate cuts.

Link to Canada’s April CPI Report

Here are key points from April’s CPI report:

- Annual inflation dropped to 1.7% in April from 2.3% in March (analyst forecast: 1.6%)

- Energy prices fell 12.7% year-over-year, with gasoline prices tumbling 18.1%

- Food prices accelerated to 3.8% annual growth from 3.2% in March

- Two of the Bank of Canada’s three core inflation measures rose to 13-month highs

- CPI median increased to 3.2% from 2.8%, while CPI trim rose to 3.1% from 2.9%

- Markets reduced odds of a June rate cut to 48% from 65% following the release

The steep decline in headline inflation largely reflected the removal of the federal carbon price, which dramatically lowered energy costs. However, the Bank of Canada typically looks beyond such one-time impacts to focus on underlying price pressures, which actually intensified in April.

Food inflation is proving particularly stubborn, with grocery prices rising at a faster pace (3.8%) than the overall inflation rate for three consecutive months. Travel tours and restaurant meals also saw accelerating price growth, suggesting that services inflation remains persistent.

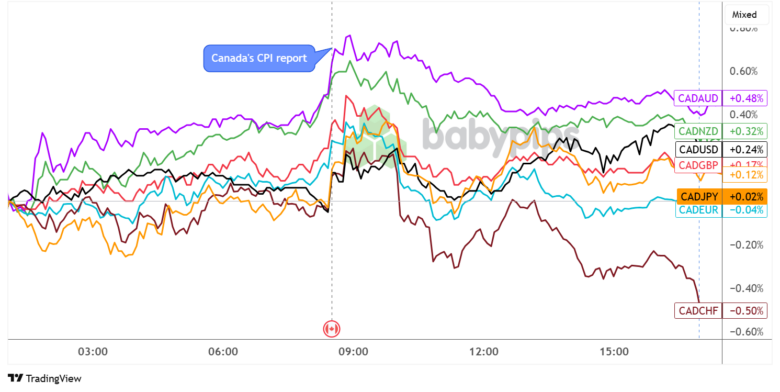

Overlay of CAD Pairs vs. Major Currencies Chart by TradingView

The Canadian dollar strengthened immediately following the inflation release, posting gains against most major currencies as stronger than expected core inflation readings likely prompted investors to pare bets on another BOC cut in its June meeting.

Although the Loonie let go of most of its initial gains a few hours after the report, it chalked up notable advances against the Australian dollar (+0.48%) and New Zealand dollar (+0.32%), while also gaining against the U.S. dollar (+0.24%) and British pound (+0.17%). CAD retreated back to pre-CPI levels and negative territory against CHF (-0.50%) and EUR (-0.04%) by session’s end.