With not a lot of fresh catalysts to consider, the markets are starting to position themselves ahead of anticipated data releases on Wednesday and Thursday.

Which headlines moved the major assets anyway?

We’re discussing Tuesday’s major market movers:

Headlines:

- Westpac: Australian consumer sentiment dipped 0.5% from 85.0 to 84.6 in September; Focus may be shifting from cost of living to job prospects

- NAB: Australia’s business confidence fell from 1 to -4 in August, the first negative reading in three months

- China trade surplus widened from $67.81B to $91.02B in August as exports (+8.7% y/y) outpaced imports (0.5% y/y)

- Japan preliminary machine tool orders dropped by 3.5% y/y in August after an 8.4% y/y increase in July

- Germany’s final inflation confirmed at -0.1% in August

- U.K.’s jobs data came in mixed, with signs of cooling labour market but persistent wage pressures

- U.S. NFIB small business index dipped from 93.7 to 91.2 in August; “Historically high inflation remains the top issue for owners”

- BOE Deputy Gov. Sarah Breeden favors relaxing financial regulations to boost economic growth

- BOC Gov. Macklem said global trade disruptions may make it harder for the central bank to meet its 2% inflation target

- FOMC member Michael Barr announced a revised plan to impose a 9% rise in bank capital requirements, down from the 19% increase proposed last summer

- New Zealand visitor arrivals rose by 2.2% m/m in July; June’s reading revised higher from -0.2% to 0.5%

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

With not a lof of big data to consider, traders kept the major assets in wide ranges early in the day.

Things got a bit more lively during the European session, as risk aversion and profit-taking kicked in ahead of the U.S. CPI report and the ECB meeting. European stocks traded lower, while safe havens like gold saw a boost. Crude oil, in particular, was hit hard by weaker Chinese import data for August and OPEC lowering its global oil demand outlook for 2024 and 2025.

In the U.S. session, it was all about Fed rate cut expectations. Rate cut speculations kept bond prices climbing, driving U.S. 10-year bond yields to their lowest close in over a year.

Bitcoin (BTC/USD) also rebounded from its lows, ending the day just below $58,000. Meanwhile, WTI crude recovered some losses, bouncing from $65.30 to $66.25. As for U.S. stocks, they had a mixed day. The S&P 500 and Nasdaq edged higher, while the Dow slipped, weighed down by concerns over the banking sector.

FX Market Behavior: U.S. Dollar vs. Majors:

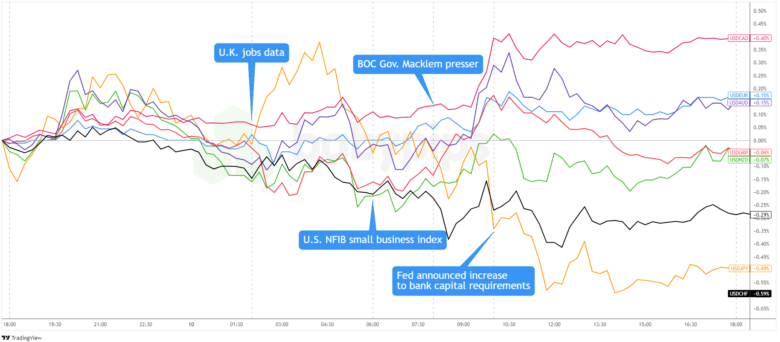

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar kicked off the day strong, continuing its upswing from the previous U.S. session. But Asian traders weren’t too keen on the rally, and the Greenback dipped as the market started betting on a more dovish Fed decision later this month.

Price action got choppier in the following sessions, with events like the U.K. jobs report and Bank of Canada Governor Macklem’s press conference driving moves in their respective currencies.

Overall, we saw a risk-off mood, where “risk” currencies like EUR, GBP, AUD, CAD, and NZD all traded lower while safe havens like CHF and JPY gained ground. This is likely due to the uncertainty ahead of the U.S. CPI report and the European Central Bank’s decision on Thursday.

USD/JPY extended its losses from the European session, making it the weakest of the major dollar pairs. While the dollar found some support against its other counterparts at the start of the U.S. session, it eventually drifted lower from its intraday highs.

Upcoming Potential Catalysts on the Economic Calendar:

- U.K.’s monthly GDP at 6:00 am GMT

- U.K. goods trade balance at 6:00 am GMT

- U.K. 3-month services index at 6:00 am GMT

- U.K. industrial production at 6:00 am GMT

- U.K. manufacturing production at 6:00 am GMT

- U.S. CPI reports at 12:30 pm GMT

- U.K. CB leading index at 1:30 pm GMT

- EIA crude oil inventories at 2:30 pm GMT

- U.K. RICS house price index at 11:01 pm GMT

- Japan BSI manufacturing index at 11:50 pm GMT

- Japan PPI reports at 11:50 pm GMT

News traders huddle up! The U.K. will see a parade of mid-tier economic reports that may move Sterling around during the London session.

In the U.S., the anticipated August inflation reports are expected to mostly maintain their previous readings and keep Fed interest rate cut speculations at 25bps.

Think you can catch pips from these releases? Keep your eyes glued to the tube!

Don’t forget to check out our brand new Forex Correlation Calculator!