The FOMC lowered interest rates by 50 basis points to 4.75% to 5.00% in their September meeting, marking an aggressive start to their monetary policy easing cycle.

This was also the first reduction in borrowing costs since the start of the pandemic in 2020 during which major central banks announced emergency easing measures. The last time the Fed slashed rates by 0.50% was during the financial crisis of 2008.

According to their official statement “The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

Link to official FOMC Statement (September 2024)

In addition, their updated economic projections indicated downgrades to headline inflation from 2.6% to 2.3% and core inflation from 2.8% to 2.6% this year. The committee also raised their estimates for unemployment from 4% back in June to 4.4%, underscoring the view that “job gains have slowed and the unemployment rate has moved up but remains low.”

Meanwhile, the dot plot forecast of interest rate projections revealed that policymakers foresee an additional 50 basis points in rate cuts for the remainder of the year.

Also, the dot plot also predicts an additional 1.00% in interest rate cuts for 2025, plus another 0.50% in reductions for 2026.

Link to FOMC Summary of Projections

During the press conference, Fed head Jerome Powell reiterated that they are committed to restoring price stability without sacrificing employment.

Although he cited that longer-term inflation expectations remain well-anchored and that the economy is strong overall, Powell also cautioned that there was broad support for a 0.50% rate cut during the September meeting. After all, majority of policymakers voted in favor of this move, with only one dissenter (Michelle Bowman) calling for a smaller 0.25% cut.

Market Reactions

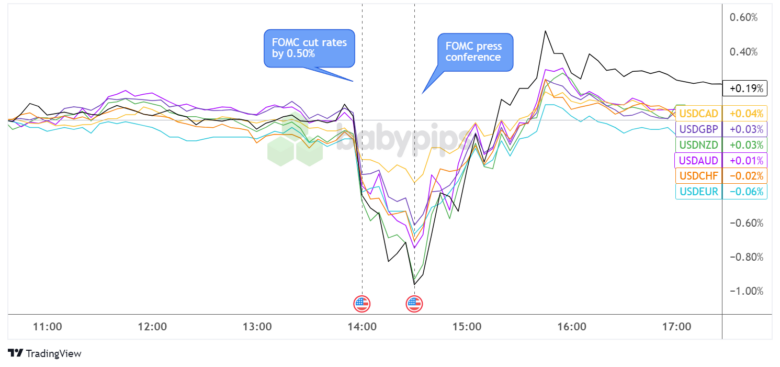

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

After trading nervously in tight ranges against its forex peers a few hours ahead of the FOMC decision, the U.S. dollar broke lower across the board upon hearing the larger 0.50% Fed rate cut.

The Greenback kept cruising lower after the official announcement, as the FOMC Summary of Projections also reflected downgrades to inflation and employment forecasts, before pulling higher during the press conference.

Fed head Powell’s remarks appeared to dash hopes of another mega 0.50% reduction in borrowing costs, as he assessed that the U.S. economy remains strong thanks to robust consumer spending, even as the dot plot forecasts suggested a couple more easing moves before the year ends.

With that, the U.S. currency managed to recover back to its pre-FOMC levels roughly an hour after the presser, with USD/JPY and USD/CHF even trading higher for the remainder of the session.